IETC: An active technology strategy for superior performance

gremlin

The active vs. passive debate rages on. In general, active strategies are more likely to outperform passive strategies in more volatile environments. We could be in that phase. So if you’re still bullish on technology (I’m not), I recommend iShares. US technology independence ETF (BATS:IETC) seems to be a candidate.

problem? Active doesn’t seem to be working here, even during volatile times.

Founded on March 21, 2018, IETC is an actively managed fund designed to provide investors with exposure to U.S. companies with a focus on technology independence. Using proprietary data from our parent company, BlackRock, we aim to understand the evolving landscape of technology-focused companies. IETC’s strategy is to focus on companies that could benefit from more resilient value chains, thereby mitigating potential risks from global supply chain disruptions.

IETC had a net Assets are $164 million. It holds 168 stocks, with a 30-day SEC yield of 0.81% and an expense ratio of 0.18%.

IETC Holdings: Detailed Analysis

IETC’s holdings are spread across a variety of sectors, with a particular focus on the technology industry. His top 10 holdings account for nearly 56% of the fund’s total assets. These include:

-

Microsoft Corporation (11.73%): A multinational technology company known for software products such as the Microsoft Windows operating system, the Microsoft Office suite, and the Internet Explorer and Edge web browsers.

-

Broadcom Corporation (7.41%): A leading designer, developer, and global supplier of a wide range of semiconductor and infrastructure software solutions.

-

Accenture Plc Class A (7.21%): A multinational professional services company specializing in IT services and consulting.

-

Salesforce (6.26%): A cloud-based software company that provides customer relationship management services and enterprise applications.

- Amazon.com Inc. (6.16): American multinational technology company focused on e-commerce, cloud computing, digital streaming, and artificial intelligence.

No big surprises here for technology funds.

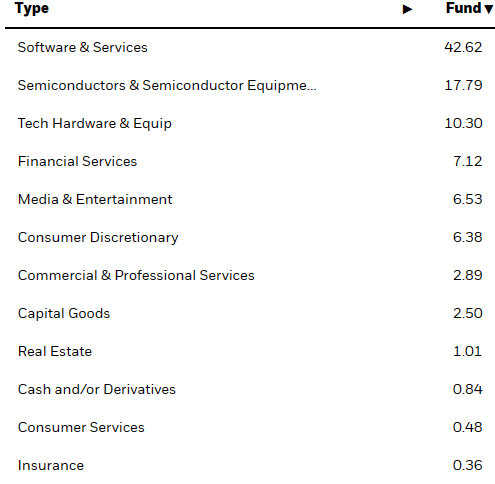

Sector composition and weighting

IETC’s portfolio is primarily concentrated in the technology sector, with sub-sectors such as software and services, semiconductors and semiconductor equipment, and high-tech hardware and equipment accounting for the majority of the fund’s holdings.

shares.com

This sector allocation demonstrates IETC’s commitment to investing in the technology sector while diversifying into other sectors to reduce risk.

IETC vs. Peers: Comparative Analysis

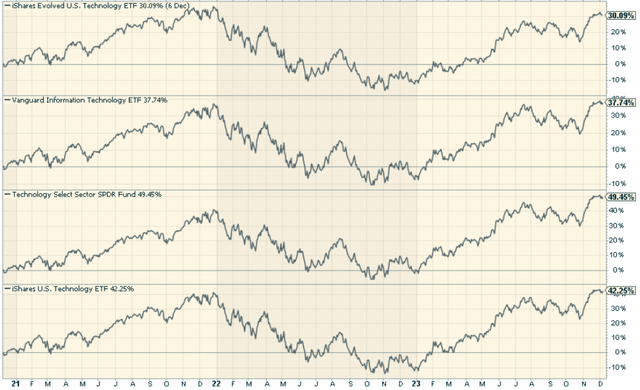

To fully understand IETC’s positioning, it is essential to compare it to similar ETFs on the market. This comparison looks at Vanguard Information Technology ETF (VGT), Technology Select Sector SPDR Fund (XLK), and iShares US Technology ETF (IYW).

The fund has underperformed in each of the past three years. The reality is that it is very difficult to actively break through passive technology exposure.

stockchart.com

Pros and cons of investing in IETC

Strong Points

-

diverse exposure: IETC provides diversified exposure to US companies with a focus on technology independence. This strategy can offer investors higher returns and lower risks compared to investing in individual stocks.

-

strong performance: Since its founding, IETC has lagged behind other technology proxies but has delivered impressive gains.

-

low expense ratio: IETC has an expense ratio of 0.18%, making it cost-effective compared to many other sector-specific ETFs.

Cons

-

concentration risk: Although IETC is diversified across a variety of sectors, it remains heavily concentrated in the technology sector. This concentration can expose investors to sector-specific risks.

-

market volatility: Given the fast-paced nature of the technology industry, IETC is subject to high market volatility.

Conclusion: To invest or not to invest?

On the surface, the active management style might be worth considering against the more popular passive technology sector ETFs, but given the sector’s high valuations and lackluster relative performance, , I’m not sure if this is worth considering. It’s an interesting approach on the active side, but it hasn’t happened yet.

Markets are not as efficient as conventional wisdom would have you believe. A gap often appears between market signals and investor reactions, and this helps indicate whether we are in a “risk-on” or “risk-off” environment.

of Lead lag report Gain an edge in reading the market and make asset allocation decisions based on award-winning research. I’ll give you a signal – go on the offensive (i.e. add exposure to risky assets such as stocks when risk is “on”) or go defensive (i.e. add more conservative assets) It’s up to you to decide whether to lean towards it or not. as bonds/cash if risk is “off”).

Source link