Forget IPOs, climate tech investors are chasing another exit

This article is the latest in a series focused on climate infrastructure startups. read shifted book Initial infrastructure launch paper, our analysis of how to fund them and our view is The intersection of infrastructure and software.

Solving the climate crisis will require massive amounts of new hardware and physical infrastructure. A new wave of startups is doing just that. We are building things like battery manufacturing and carbon removal plants to support the transition to a low-emissions economy.

These climate startups are different from the software companies that venture capitalists are accustomed to (and have often made their fortunes from). They are capital intensive, have diversified cap tables, and are often funded by infrastructure funds and real estate investors in addition to venture capital.

And many companies are considering another exit route: selling to private equity firms.

Enter PE exit

The typical path for a software startup to exit is well known. Raise money from VCs and then look at an initial public offering (IPO).

In the hardware and infrastructure space, exit strategies are less clear-cut, says Stefan Mardo, general partner at VC fund Climentum. “There are three routes: the typical IPO route, a trade sale to the company, and a third, a private equity exit.”

Private equity (PE) firms typically invest in mid- or mature-stage companies by acquiring majority stakes. They take less technical risk than venture capitalists and prefer companies with technologies that have been proven at scale and are already profitable.

Another typical PE strategy is to acquire a number of different companies in the same industry, merge them, streamline them, and sell them at a higher valuation.

PE models have long been used in infrastructure sectors such as mining and oil reserves. Green infrastructure is at a ripe time for PE-style investments, says Murdo. Many of the technologies are proven and ready to scale, as there is an urgent need to green the infrastructure around us.

Sebastian Heitmann, general partner at VC fund Extantia Capital, says that for VCs, getting a PE firm onto the cap table could mean a payday. “For VCs, when PE comes in, it’s common for them to exit and sell their shares,” he says.

PE firms raise climate change funds

Large-scale PE financing that takes climate change into consideration is occurring one after another.

US PE fund KKR, which closed its $8 billion European fund earlier this year, hired a new co-head of climate change strategy in August this year. As part of KKR’s infrastructure platform, it will focus on climate-related investments.

Danish PE fund Copenhagen Infrastructure Partners (CIP) closed the first part of its renewable energy fund for $6.2 billion in July this year. The company has a large portfolio of renewable technologies including wind, solar, photovoltaic, biomass and energy storage.

Carbon capture and green steel

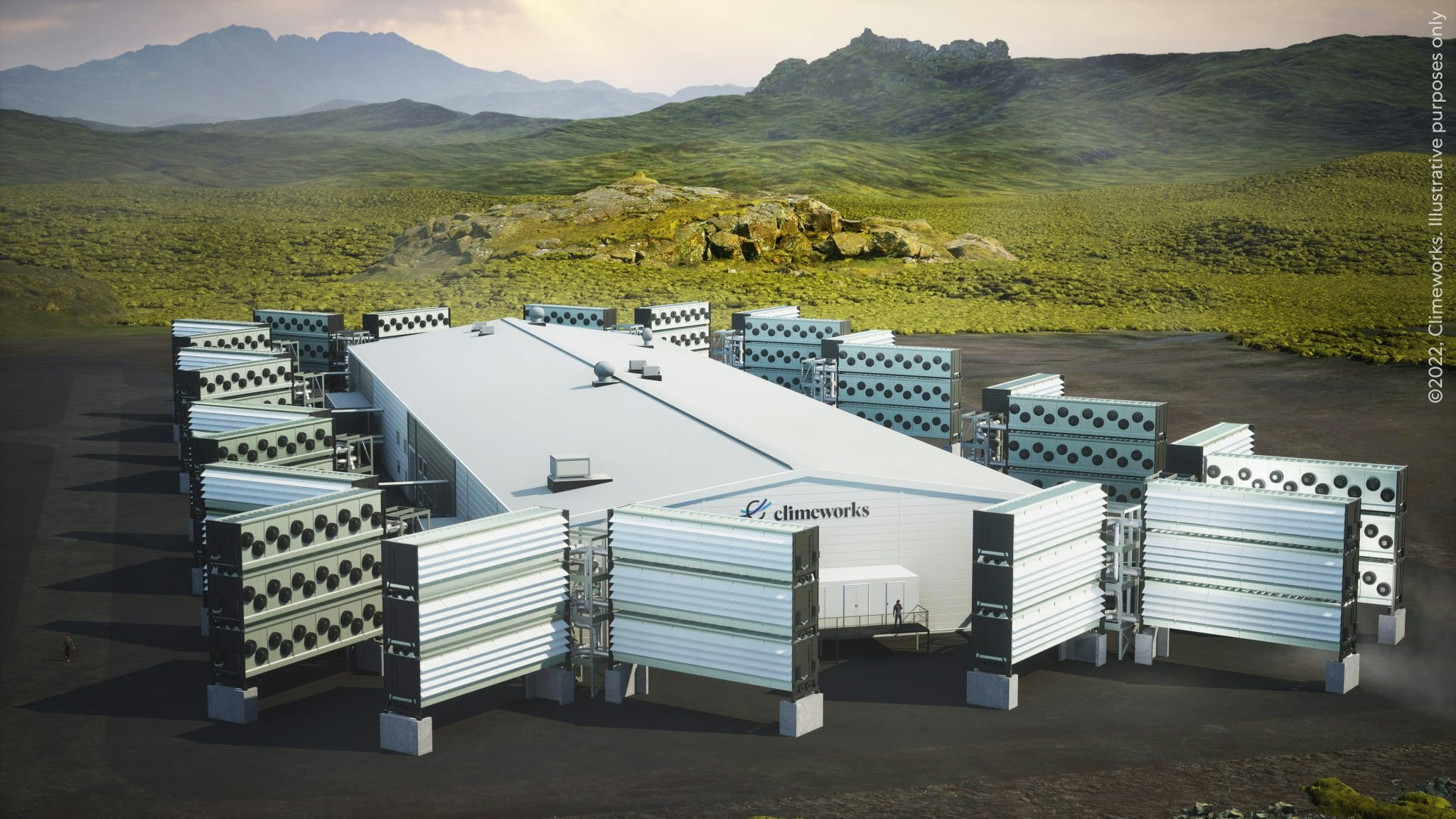

Carbon removal startup ClimeWorks is one of Europe’s most respected climate technology companies and received investment from Swiss PE firm Partners Group in August last year. Climeworks has proven its technology works at scale and is currently in the deployment phase, making it a perfect time to secure PE backing.

CrimeWorks told Shifted that Partners Group had acquired a minority stake in the company, but declined to comment on whether previous investors had sold their shares at the time.

H2 Green Steel, a Swedish unicorn building hydrogen-powered steel manufacturing plants, has also secured private equity. Nordic-based PE firm Altor Equity Partners backed the company in three consecutive rounds.

For Altor partner Klas Johansson, H2 Green Steel is a perfect example of the type of company that uses proven technology and is working on a model for deploying it, making PE capital an option. It’s a stage.

“Reducing iron directly to steel using electricity has been around for a long time, but no one has been able to build the steel production capacity. “Nobody thought about completely changing the footprint of the steel product,” he says.

“It’s important to be smart and leverage different input variables and existing technologies to form new innovations.”

Unlike many PE firms, Altor does not tend to acquire majority stakes in businesses, preferring to work with existing investors and founders. They line up with other investors on his H2 Green Steel cap table.

Johansson said Altor sees opportunities in solar, wind, batteries, green steel and heat pumps, which require “rethinking the value chain and implementing existing technologies” in these areas. PE firms like Altor can help develop a competitive business case around proven technology and scale it up, he says.

Risk: Lack of funds

Extancia Capital’s Heitman said that despite the recent flurry of new PE fund raisings focused on climate-related hardware and infrastructure, startups are still at a point where they can get some of the funding. There are still pitfalls that could hinder this, says Extancia Capital’s Heitman.

In Europe, it is widely known that there is a gap in funding for climate technology startups beyond the Series B stage, and that this gap is preventing startups from reaching a stage of sufficient scale to secure PE funding. It may be hindered.

That said, there have been recent signs that PE firms are more willing to back companies earlier without the same amount of revenue they were previously seeking, which could lead to a reduction in PE and VC checks. The gap may narrow.

For example, Altor backed Aira, a heat pump deployment startup that launched earlier this year. Aira is pre-revenue (so it’s not a typical PE case), but it’s also not a venture capital case because the technology risk is completely eliminated.

“We call these companies industrial scale-ups,” Johansson says. “We are actively looking for that opportunity.”

As more climate hardware technologies mature to the point where they are de-risked and enter the deployment stage, we will see more PE deals coming in. This could provide an alternative exit route for VCs that joined the cap table early.

This article was updated on Dec. 4 to include that Climeworks told Sifted that Partners Group had acquired a minority stake in the company.

Source link