Prepare For What May Be An Epic Chance To Buy Big Tech… If Oil Spikes

adventtr

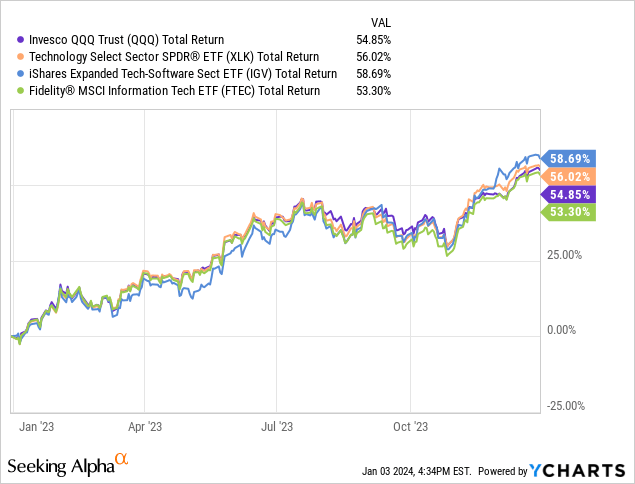

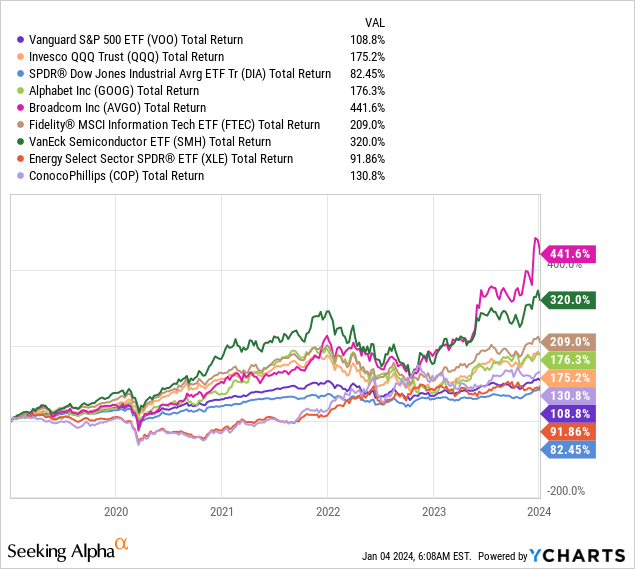

As most of you surely know, stock market returns last year were dominated by the so-called “Magnificent 7” big tech stocks. Indeed, these stocks and all of the well-known technology ETFs (like (QQQ), (NYSEARCA:XLK), (IGV) (FTEC), etc.) delivered total returns of greater than 50%, or more than two times those of the S&P 500 (see graphic below). However, the rally has faltered over the first two trading days of this year and consensus is building that a mega cap rout is on the way. Given the group’s out-sized gains last year, general profit taking, armed conflict in Ukraine and the Middle East, rising oil prices, and a stronger U.S. dollar, a significant sell-off in big tech is certainly a distinct possibility. If so, it would likely be a great buying opportunity for those investors who are underweight technology stocks and looking for an excellent entry point into the sector.

Investment Thesis

While there does seems to be some variety in the composition of the list, the total returns of the so-called “Magnificent 7” (as defined by the author) certainly lived up to that reputation last year:

- Nvidia (NVDA): +239%

- Microsoft (MSFT): +58.2%

- Amazon (AMZN): +80.9%

- Google (GOOG) (GOOGL): +58.8%

- Apple (AAPL): +49%

- Tesla (TSLA): +101.7%

- Meta Platforms (META): +101.4%

The significant out-performance as compared to the broad market averages has many predicting a Mag 7 “rout” this year. Indeed, Seeking Alpha reported on Tuesday that respected BofA strategist Savita Subramanian said:

Crowding risk in the leaders of 2023 has been cited by many (including ourselves) as a key risk in 2024. In particular, year-end ‘window dressing’ may have pushed active funds into big tech leaders, but these stocks could be used as a source of funds if a hard landing is avoided and leadership broadens beyond secular growth stocks. Some of this theme has played out – the equal-weighted S&P 500 (RSP) has handily outperformed the cap-weighted index (SPY) (IVV) (VOO) since mid-November. We hear from our clients that a broadening of market leadership is now as consensus as the unwavering bond love / equity hatred we heard at the end of 2022. The January pain trade may thus be higher TMT/mega caps.

Author’s Note: “TMT” refers to “technology, media, telecom.”

In other words, Subramanian views this “consensus” as a contrarian indicator and that the “pain trade” may well be that the mega caps continue to push higher. While I agree, my take is more nuanced. Let me explain.

Is The Santa Claus Rally Over?

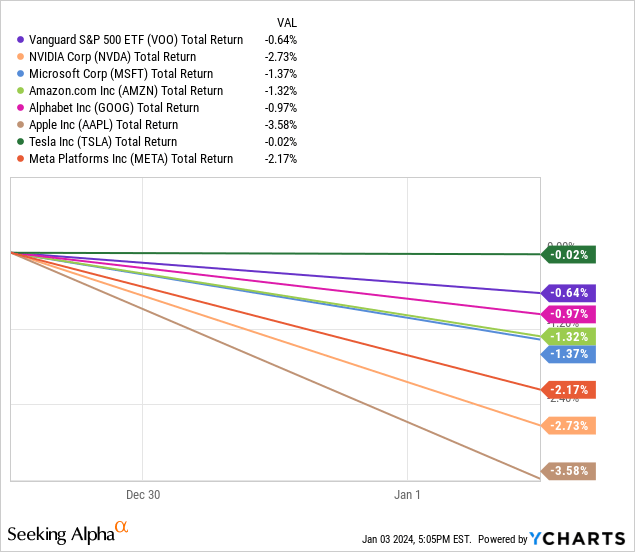

Over the first two trading days of the year (and the last two trading days of 2023), the “rout” narrative certainly appears to be in place. Indeed, as compared to the S&P 500 (as measured by the Vanguard S&P 500 ETF (VOO), all of the Mag 7 except Tesla have significantly underperformed year-to-date:

Apple, in particular, has taken it on the chin. Apparently many investors are not convinced that AAPL stock’s move last year (+49%) and its current arguably high TTM P/E = 30.1x, was not substantiated by the company’s top-line revenue that actually declined 2.8% year-over-year.

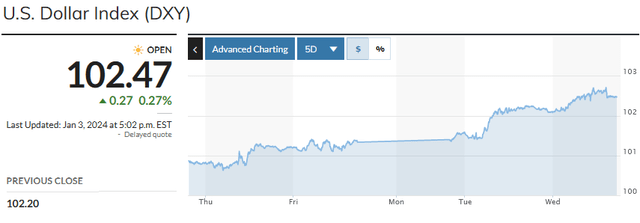

Now, obviously two days does not make a market. However, my opinion is that there are other dynamics at work here: Specifically, rising oil prices, strength in the U.S. dollar index and higher interest rates:

MarketWatch

As you can see from the above graphic, in the first two trading days of 2024 the U.S. dollar has risen (arguably pushed by higher oil prices) from 101.39 to 102.47 (+1.1%). Meantime, the yield on the 10-year Treasury headed back up to 4%. Now, to many investors this may not seem like much to get concerned about. However, it’s the trend that’s worrisome because it is important to consider that this move is happening despite the general consensus that the Federal Reserve is expected to significantly cut interest rates this year (i.e. usually leading to a weaker U.S. dollar, not stronger), right? It’s also important to remember what arguably was a primary cause of the bear-market tech rally in 2022: A stronger U.S. dollar and higher interest rates.

Those two factors are negative for tech stocks for two reasons: Many of them have strong global brands that get a large percentage of revenue from overseas (i.e. repatriating foreign revenue back into a strong U.S. dollar is a negative exchange) and because higher interest rates generally reduce the future discounted cash flow valuation premium that fast growing technology companies typically enjoy when rates are either steady or falling.

All that said, it may be more important to understand what’s behind the move higher in the U.S. dollar.

The Global Oil Market

As most of my followers know, it’s my belief that the primary driver of inflation is the price of a barrel of oil. Sure, we had strong food inflation last year – but that was mostly due to Russia/Ukraine conflict which kept significant grain exports off the global market. The bigger impact on inflation after Russia’s invasion of Ukraine was that it broke the global energy supply chain and led to a big spike in oil prices over $125/bbl:

MarketWatch

The other thing to note on the above graphic is that, and as is so typical of Middle East events, the price of Brent crude jumped higher right after the Hamas attack on Oct. 7, but has since retreated because there had been no actual and significant supply disruptions. What happened Tuesday was that both Brent and WTI oil prices jumped ~3% higher as a result of an incident in Iran which ratcheted up tension, but more importantly due to an actual oil supply disruption: Protestors shut-down 300,000 bpd of crude production at Sharara, Libya’s largest oil field. This was an actual reduction of oil supply. Up to that point, the Red Sea antics by the Houthi rebels had only caused increased time and expense because oil supplies were simply re-routed around the Horn of Africa.

This could be a taste of what could potentially be much larger oil production restrictions if armed conflict were to widen across the Middle East. This is why I advise all well-diversified investors to always have adequate exposure to energy companies like Chevron (CVX), ConocoPhillips (COP), and Exxon (XOM) in their portfolios. These stocks not only deliver excellent dividend income and dividend growth (Chevron recently announced plans to raise its quarterly dividend 8%, to $6.52/share annually), but they also protect investors from the ravages of inflation. One only has to look at the performance of these stocks during the 2022 bear market to see the benefit of owning them.

To bring this discussion back full circle, and what has been proven many times going all the way back to the Arab embargo of the late 1970s, oil price spikes higher lead to rising inflation which leads to rising interest rates which, in turn, leads to a stronger U.S. dollar.

The Good News

The good news for Americans, the American and global economies, and American equity markets – is that, despite the false narrative spun by many far-right politicians, the U.S. is now strongly energy independent. Here are the simple and easily verifiable facts:

- The U.S. is the No. 1 petroleum producer on the planet.

- The U.S. is the No. 1 oil producer on the planet.

- The U.S. is the No. 1 LNG exporter on the planet.

- The U.S. is growing oil exports.

- The U.S. is absolutely swimming in NGLs (propane, butane, and ethane) and is ramping up NGLs exports.

Now, the far right politicians typically point to the fact that the U.S. still imports ~8 million bpd, and that’s certainly true. But that simplistic analysis is akin to the shallow end of the kiddie pool. I say that because any energy analyst worth his weight in salt knows that the only reason the U.S. still imports that much oil is because we maxed out our domestic light sweet refining capacity years ago. That is, prior to the shale revolution, the general consensus was that the U.S. would be importing sour and heavy grades of oil – primarily from Canada, Venezuela, and Mexico far into the future. As a result, refiners spent tens of millions of dollars to configure their refineries to run those feedstocks. Today, there’s booming domestic shale production (i.e. light-sweet crude) and, since light-sweet refinery capacity is already maxed out, all incremental production of light-sweet is exported (or put into storage).

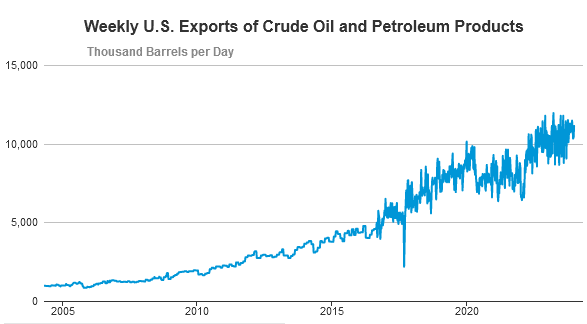

The result, and combined with exports of LNG, NGLs, and refined products, the U.S. exported a whopping 11.1 million boe in December:

EIA

So, not only is the U.S. energy independent, it’s energy independent by a mile – or about 3 million boe/d.

That being the case, the U.S. (and its Democratic and NATO allies) is in a much stronger position as compared to what it was in during the Arab embargo of the 1970s or when oil spiked during the Iraq war – which took millions of bbls of crude off the global market just as China was ramping up oil imports.

The other good news, and what we have also learned from history, is that these Middle East conflicts are typically resolved – and resolved in a relatively short period of time. That’s because it’s in no one’s best interest – not the oil producers, or the oil consumers, or the leaders of all countries involved – to see the global economy crash due to a massive increase in oil prices. What this means is that investors need to be ready to act on these relatively short-term developments.

What To Watch

Despite America’s energy independence, if armed conflict spreads in the Middle East, and if that conflict meaningfully reduces the global oil supply, the price of oil will move higher – and perhaps significantly higher (at least for a relatively short period of time). That will drive inflation higher, interest rates higher, and the U.S. dollar higher.

If all that actually comes to fruition, it would likely lead to a “rout” of leading U.S. technology stocks due to the reasons mentioned earlier. In my opinion, that would be another huge opportunity to buy these stocks on sale – very similar to December of 2022 after the technology bear market had run its course.

That’s because, as I have been reporting on Seeking Alpha for what seems like years now, the leading tech companies all have very strong global brands, very healthy cash positions, and generate tremendous free cash flow.

For example, Google ended last quarter with $120 billion in cash. All things being equal (but acknowledging they seldom are), if that money was simply sitting in a 5% money market fund it would generate $6 billion of net income. That’s actually more than the total revenue of some of the companies in the S&P 500. The story is similar across many of the big tech stocks (but not all of them).

What To Do

Given the scenario above, which obviously may or may not actually happen, investors wanting to increase their exposure to big tech should have a “watchlist” of prospective companies and ETFs ready and waiting to act upon should an excellent opportunity fall into their lap. Here are some stocks to stay clear of as well as some buy suggestions.

China Presents Challenges

Despite Apple’s strong free cash flow profile, and its significant share buyback plan, I think the stock has gotten ahead of itself. That’s especially the case given weakness in China sales due to domestic brand competition in handsets combined with deteriorating top-line growth. Apple doesn’t make my list.

Ditto Tesla – which is facing strong margin pressure in China due to price cuts just to keep moving inventory. TSLA’s TTM P/E of 76.7x is too rich for my taste given expectations for continued margin contraction and strong global EV competition from a variety of exciting new makes and models. In addition, Elon Musk frequently makes comments that are increasingly distasteful to many consumers who would otherwise consider buying a Tesla (the author is among them). As a result, in my opinion, Musk has actually accomplished what all the Tesla naysayers haven’t been able to do for years: Tarnish the Tesla brand.

On the upside, Google remains my No. 1 mega-cap tech stock pick. GOOG is a free cash flow giant and trades at a TTM P/E of only 26.9x. Despite the false narrative that Microsoft and ChatGPT will somehow “kill Google,” see: Q2 Surprise: Google Generated $2 Billion More Free-Cash-Flow Than Microsoft. Meantime, I don’t know anyone who has traded in Google Search for Bing on their browsers.

Furthermore, I would argue that Google (and its Deep Mind asset) is actually ahead of Microsoft in AI. After all, Deep Mind AI solved the long vexing protein-folding problem four years ago. Arguably, ChatGPT has not made any scientific contribution to mankind anywhere near as impactful as that achievement. Meantime, Google is on its fourth generation of AI silicon and Microsoft/OpenAI has yet to achieve first silicon. Indeed, as I reported on earlier Seeking Alpha, it was arguably Sam Altman’s trip to the Middle East to get funding for AI chip designs that kicked off the whole OpenAI drama to start with (see OpenAI: Hoisted By Its Own Petard). And, remember: Elon Musk, Sam Altman, and Greg Brockman founded OpenAI in the first place because they were very concerned about Google’s dominating lead in the field. Point being: Google has been a leading AI company and has been monetizing AI in search (and other products) for years.

I continue to be very bullish on semiconductors. My sole individual stock holding is Broadcom (AVGO). Am I the only one that has noticed that, after doubling in price last year, Broadcom is now up to the No. 11 holding in the S&P 500? See Broadcom: A 20:1 Stock Split Is Likely.

I also advise a diversified approach to semis: Funds like the VanEck Semiconductor ETF (SMH) and the SPDR S&P Semiconductor ETF (XSD). I own SMH for excellent exposure to Taiwan Semiconductor (TSM) and Nvidia, while the XSD is an equal-weight fund of only U.S.-based companies. Both of these equities would be excellent long-term additions to a well-diversified portfolio on a significant pullback.

My followers also know that I’m also very bullish on the long-term prospects for big-cap software companies. After all, AI is not the only catalyst: Virtually all the big SW companies operate SaaS-based platforms that can very easily be scaled-up to add new customers (i.e. margin expansion and excellent growth in free-cash-flow). This is a volatile sector, so my suggestion is a diversified ETF like the iShares Expanded Tech Software ETF. See: IGV Software ETF rides AI To A 35% Gain and note that article was written in early November, prior to the big year-end rally. I also like the Fidelity MSCI InfoTech Index ETF (FTEC), but wish it would sell down what I consider to be its overly big stake in Apple and allocate more capital to companies like Nvidia and Broadcom.

Risks

Obviously the risk to my thesis would be if the conflict in the Middle East is relatively contained and global oil supply is not significantly restrained. If that is the case, and as I have been writing on Seeking Alpha, the global oil market is very well supplied (see ConocoPhillips In “The Age of Energy Abundance”) and I would expect oil prices to continue to weaken this year. Indeed, without OPEC+ holding 3-4 million bpd off the global market, we’d likely see Brent at ~$50/bbl (or less …), instead of in the $70-$80/range. In this case, investors under weight in big tech and wanting to build a more diversified portfolio should consider scaling in over time (dollar cost averaging) into some of the companies and funds mentioned in this article. Anecdotally, it took me three years to achieve a full position in the QQQ ETF. Patience can be a valuable asset too.

Summary And Conclusion

There’s a relatively high possibility that armed conflict in the Middle East could escalate and result in a meaningful restriction to global oil supply. If that is the case, I would expect oil prices, inflation, interest rates, and the U.S. dollar to strengthen. That would likely cause a significant pullback in big tech stocks and present investors with an excellent (and relatively short term) opportunity to increase their ownership in the sector “on the cheap.”

I’ll end by comparing the five-year total returns of some of the leading tech stocks relative to the broad market indexes (as represented by the VOO, QQQ, and (DIA) ETFs), as well as to the SPDR S&P Energy ETF (XLE) and ConocoPhillips. Note the obvious advantage of having strong exposure to the technology and energy sectors through the cycles:

Source link