5 ways construction technology founders can win in 2024

Construction often gets a bad rap as one of the “dinosaur” industries. This is not entirely unreasonable. Productivity growth in this sector over the past 20 years has averaged only 1%, while in other industries it was 2.8%. Nevertheless, over the past 12 months, we have spoken to many developers, builders, materials suppliers, construction technology entrepreneurs, and investors who believe that the industry is much more open than many realize. I believe in experimenting and embracing technology.

The built environment faces opportunities and challenges of unprecedented scale, including growing global demand for infrastructure and housing. Labor shortage continues to worsen. cost inflation. Supply chain disruption. ESG (Environmental, Social, Governance) Requirements. These challenges are forcing construction to evolve faster than ever before, and there are many ways founders can take advantage of new trends in the field.

Over the past five years, the construction industry has become more sophisticated and software-savvy. For example, 84% of general contractors have implemented autonomous solutions in the past year. Innovative technologies and ideas are impacting construction everywhere you look. These new technologies will help construction companies achieve higher levels of productivity, profitability, and safety. A technology founder may find that his construction customers are more selective in sharing and purchasing data than he was five years ago. Conversely, most general contractors now have technology budgets, clearly defined evaluation processes, and teams.

Construction technology founders that solve the most important priorities for general contractors: building on budget, on time, and within scope are well-positioned for growth in 2024.

1. Leverage the growing sub-sector of construction technology in a capital-rich market

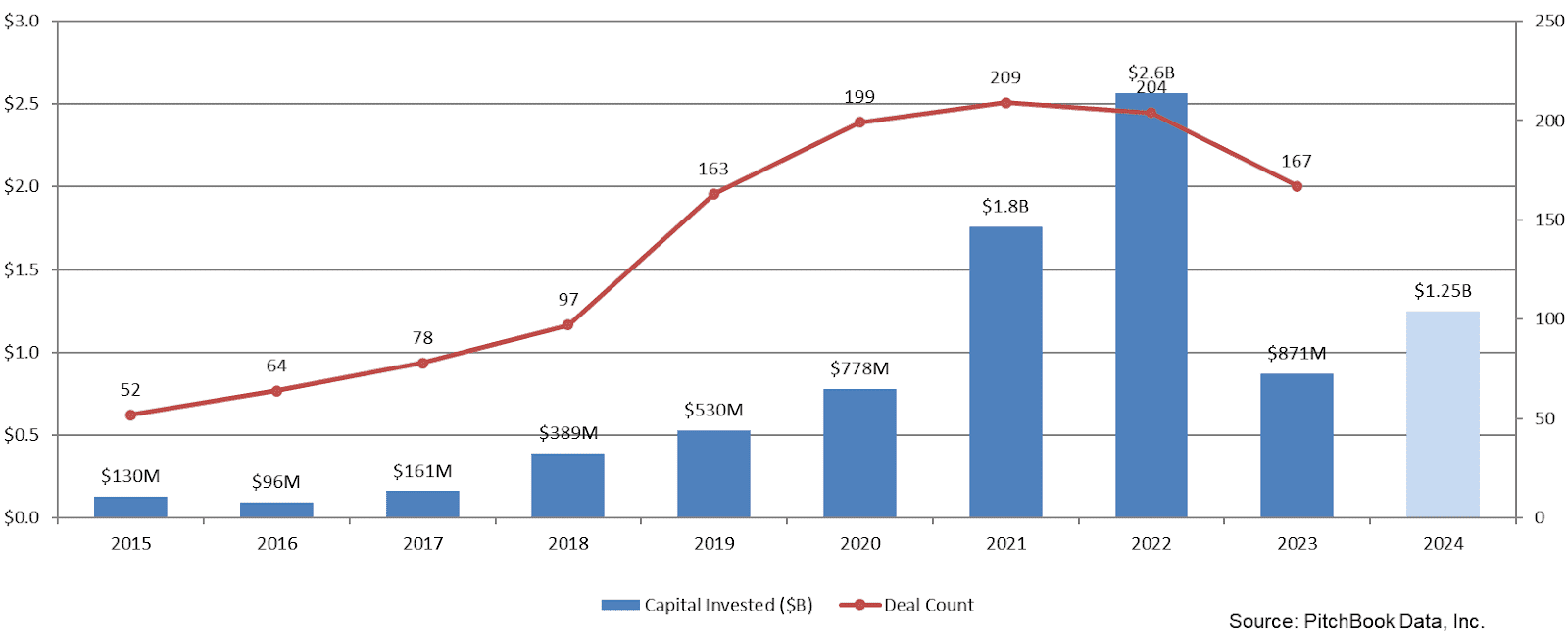

VC financing in the US construction technology sector (2013-2023). Image credits: sorenson capital

(Please note that not all closings in 2023 have been announced at this time, and that number could increase significantly.)

Construction technology founders should consider how their products can serve construction and real estate customers.

Venture capital interest in construction technology has reached a four-year high, and the last three months of 2023 have been a very active period for construction technology startup funding. I predict that 2024 will be another active year for him, exceeding 2023, with total investments going from about $1 billion to $1.5 billion (shown in light blue).

In terms of opportunity, IT spending in the construction industry represents only 1% to 2% of revenue (versus 3% to 5% in other industries). Therefore, there is ample room for use in construction technology. Buyers are also becoming more sophisticated, placing increasing emphasis on software tools that can digitize workflows and leverage data, AI, or automation to deliver superior results. Given these opportunities and market demands, 2024 should be a good year for founders to launch and raise capital for construction technology startups.

2. Promote sustainable practices that help customers achieve their ESG goals

Today’s construction and real estate industries are increasingly focused on sustainability. According to the International Energy Agency, the built environment accounts for 30% of global energy use and 26% of global energy-related emissions. As a result, governments are tightening the reins on builders and property owners to ensure that buildings comply with regulations regarding energy consumption and carbon emissions during construction and operation.

For example, a new law in New York City will require buildings larger than 25,000 square feet to meet new energy efficiency and greenhouse gas emissions standards. Penalties are severe, at $268 for every ton of carbon dioxide above the allocated limit, which research shows can reach $200 million a year for some buildings.

Regulations, building codes, and pressure from owners and tenants are increasingly forcing the construction industry to prioritize sustainability. In 2024, we expect to see a wave of ESG-focused construction technology startups. From eco-friendly materials to AI that helps design sustainable buildings, technology is helping the industry implement sustainable practices throughout a building’s lifecycle.

For example, Snaptrude is a collaborative, browser-based conceptual BIM (Building Information Modeling) tool. Think of it as a modern alternative or complement to Autodesk Revit. Snaptrude has partnered with Cove.Tool to incorporate LEED-compatible performance metrics within its design platform. Architects, designers, and LEED (Leadership in Energy and Environmental Design) consultants can collaborate to iterate designs to meet performance goals.

Green building practices are becoming the norm, and a major behavioral shift is underway in the construction industry. Construction technology founders need to think about how their products can contribute to their customers’ ESG goals. Without sustainability, you cannot understand your construction customers.

3. Build modern collaboration and communication tools

Given the current market conditions, the construction industry is more focused on profitability than ever before. But imagine hundreds of replies in his one email thread where over 20 people are CC’d. How does the job get done? Details can get buried or misunderstood, causing the entire project to fall apart. At a time when tools like Figma, Miro, Slack, Airtable, and Notion have become the norm in other industries, many construction companies are stuck in the 20th century using legacy software tools.

Improving collaboration and communication are some of the lowest hanging fruit that can improve operational excellence and enable savings. This will likely see the industry adopt modern collaboration and communication tools more aggressively and place greater emphasis on strategy in his 2024.

The growing popularity of collaborative delivery, negotiated bids, and self-executing contracts rely on collaboration and communication to be successful, and construction companies are being asked to explore best practices and tools in these areas. Improved collaboration and communication means the next stage of construction is more informed, reduces risk, and increases project transparency and certainty. All software founders should consider incorporating modern collaboration and communication features into their products. The construction industry is no exception.

In 2024, startups like Planera will bring true real-time collaboration to the construction industry and solve other collaboration problems caused by traditional software tools such as Oracle Primavera P6, email, and spreadsheets. Sho. Planera’s digital whiteboards help more contractors accurately lay out scopes of work, create estimates and bids, and create schedules for project completion. Additionally, better planning means better equipment utilization and less idling and waste. This not only increases profit margins but also reduces the total carbon footprint of each project.

4. Help construction companies achieve more with less by increasing automation and integrating HR technology.

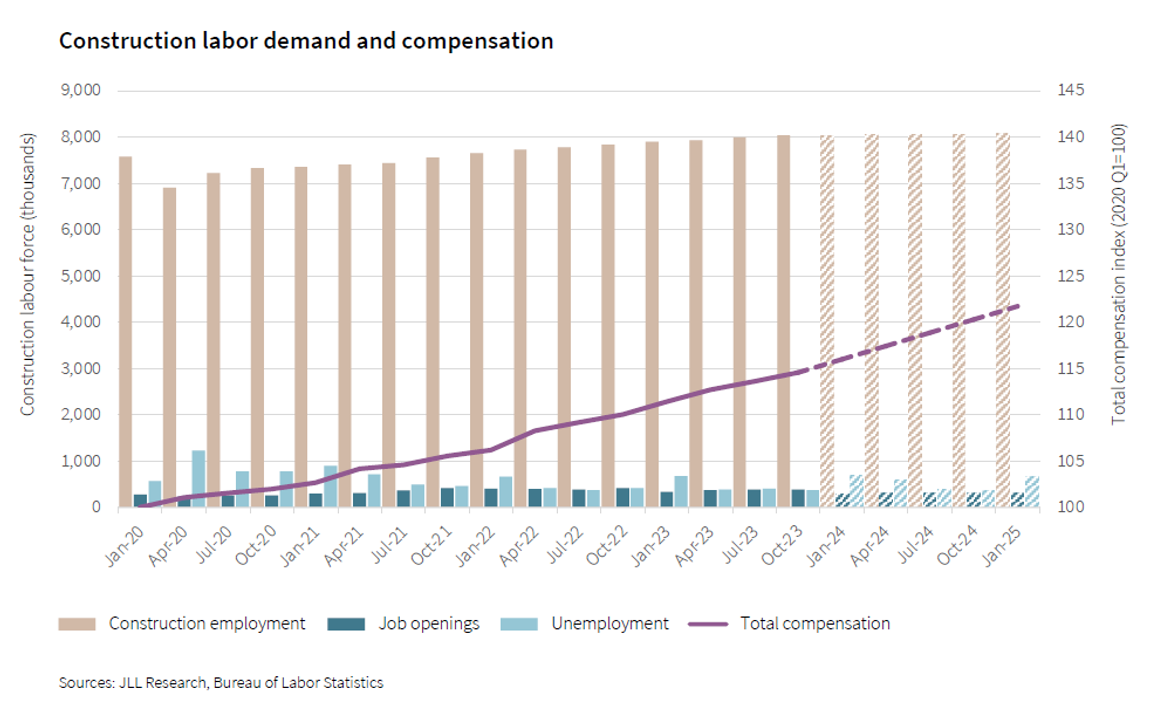

Five general contractors will be consulted, four of which will identify labor shortages and brain drain as the most critical challenges of today. Construction companies will look to automation and HR technology in 2024 to achieve more with less.

The availability of skilled construction personnel continues to decline. The industry group Associated Builders and Contractors reports that one in four construction workers is over the age of 55, and there is a need for more young workers interested in entering the profession.

Source: US and Canada Construction Trends 2024 Forecast, JLL (published November 2023). Image credits: sorenson capital

This labor shortage presents a unique opportunity for construction technology startups focused on improving productivity. Companies like construction technology company Field Materials, which is digitizing construction material procurement, are introducing automation into the “low value-add” stages of the construction value chain. Field Materials allows contractors and vendors to streamline all aspects of procurement, saving time and freeing up time for more valuable work while increasing profits and reducing costs. .

Another example is OnsiteIQ, a construction intelligence platform that uses computer vision to monitor building progress, identify issues, and enable collaboration with teammates. They digitize manual-based monitoring and provide stakeholders with real-time insights that can proactively identify issues and prevent delays and rework.

I believe that the human side of construction is the most important white space opportunity for construction technology founders. I would like to see more HR technology startups serving the construction end market. As in other industries, HR technology helps provide a better experience for employees and employees, enabling employers to better compete for and retain the highest quality workforce. . HR technologies can help automate the hiring process (e.g. FactoryFix for manufacturing). HR tech can also help with onboarding, training, and upskilling. Think Pluralsight. However, it is for construction purposes.

5. Grow your market — how your technology can serve construction and real estate customers

Valuable data and knowledge generated during construction can be carried over even after the building is completed (e.g. ISO 19650). We expect to see several companies emerge to help property owners glean insights from the data and knowledge generated during design and construction to better manage, operate, and maintain their buildings. For example, Passive Logic is a developer of robust physically-based digital twins. Digital twins can be leveraged to better design, construct, operate, maintain, and manage buildings (such as real estate).

I predict that in 2024, the line between construction technology and proptech will blur. Construction technology founders should consider how their products can serve construction and real estate customers.

There are many things you can build

As we head into 2024, there is a lot to be excited about for construction technology entrepreneurs, buyers, users, and investors.

As a construction technology investor, here’s what I look for in founders and their products:

- Ambitious founders solving big problems that impact a significant portion of the overall construction market.

- A well thought out product. This means the founders have a deep understanding of how customers do business and have a clear vision of how multiple stakeholders can interact with and benefit from the product. It means that.

Disclaimer: Planera and Pluralsight are investments of Sorenson.

Source link