Top 5 Consumer Technology Predictions for 2024

The Worldpanel ComTech team has predicted five key consumer technology trends to watch in 2024. These include rising consumer confidence, a flood of AI-powered software innovation, the rising popularity of refurbished devices, intense competition from new players, and continued competition. The spread of foldable smartphones is still slow.

The trends were identified based on an in-depth analysis of consumer behavior in six technology categories across 20 markets worldwide. This understanding has enabled Worldpanel to predict how attitudes and behaviors will change over the next year and the impact this will have on the industry.

1. Consumers’ concerns about inflation will decline as higher costs become the norm.

Shoppers hit by inflation will begin to experience a respite from rising interest rates, inflation will fall and interest rates will level off. But consumers won’t ignore high interest rates, declining household savings and rising credit card defaults anytime soon. Personal consumption is likely to remain flat or decline year-on-year.

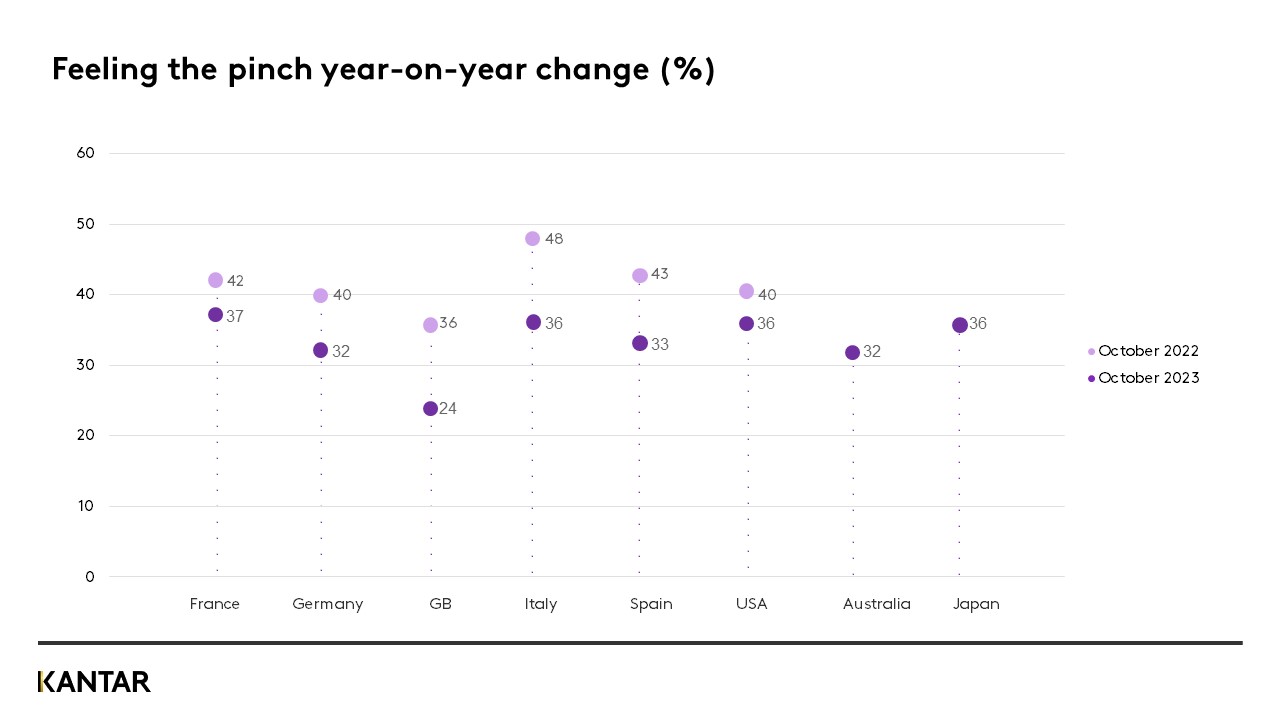

A small portion of the world’s population is “feeling the pinch” – those who are hit hardest by the effects of inflation. Consumers who are less affected by inflationary pressures do less research before purchasing a mobile phone, in part due to their healthier personal finances, and are less likely to perceive risk when making a purchase. The research they conduct is very different compared to financially constrained researchers. This indicates that as inflationary pressures normalize, we can expect to see a seismic shift in the way consumers buy mobile phones.

Enlarge image

2. AI accelerates software innovation

Breakthroughs in AI will drive the development of numerous new device features and will encourage consumer technology manufacturers to say more about their software capabilities. As hardware innovation stagnates, AI-powered “hello” software features will be developed and implemented to drive sales.

Apple has long touted unique operating system features like FaceTime, ApplePay and iMessage to lure consumers to its hardware. Competitors followed suit. Google Pixel has built his AI capabilities into its devices and has achieved impressive results, especially photo editing features that allow users to erase, move, and replace items in photos.

Consumers have responded positively. Apple and Google Pixel buyers demand “unique interaction features” from their devices to a much higher degree than the market average (+170/+136 overindex).

3. Consumers will buy more refurbished mobile phones

Refurbished and used mobile phones are expected to soar in popularity in 2024 as consumers look for ways to cut back on spending and demonstrate more sustainable behavior. Ownership has increased +70% over the past two years. 14% of smartphones sold during Christmas 2024 will be serviced/used across five European markets.

This will drive a trade-in market, with retailers and manufacturers competing to offer consumers more value on older devices to promote sales. Apple and Samsung plan to ramp up direct refurbished product offerings, aiming to take market share from third-party retailers Backmarket, eBay and Amazon, which currently hold the majority market share.

The smartphone industry has made healthy strides in sustainability in 2023. Apple has discontinued his Lightning cable for USB-C. Google has promised seven years of software updates with its latest Pixel 8 series. Samsung used recycled materials in his 12 components of his S23.

The deadline for manufacturers’ climate commitments is gradually approaching 2024. Apple and Google have committed to net-zero emissions by 2030, and Samsung by 2050. More recycled materials will be used – Samsung currently uses recycled fishing nets and plastic bottles for its plastics, while Apple’s iPhone 15 series batteries contain 100% recycled cobalt. Government pressure will improve the ease of repairing mobile phones. Consumers aren’t currently prioritizing these areas, with only 1% asking for them as features, but that percentage is expected to increase next year.

4. Samsung and Apple will face fierce competition

Samsung and Apple will remain the largest smartphone companies, but they will face increased competition from the likes of Huawei, Xiaomi, Google and Transsion (a fast-growing Chinese manufacturer in Africa).

Consumers in mainland China, the world’s largest smartphone market, are increasingly paying attention to domestic brand Huawei, led by the P60 series. Huawei’s share of total sales in the third quarter of 2023 increased by +6 percentage points year-on-year. Apple’s sales have so far not been affected by this increase, and Android is losing market share. Google Pixel will continue its strong performance with the mid-year launch of the 8 series and the Pixel 8A, a cheaper version of its flagship device. Japan, Australia and the UK are currently the best performing markets.

5. Adoption of foldable smartphones will continue to increase

In 2023, foldable smartphones still only account for 1% of all smartphones owned, and this is not expected to skyrocket in 2024. Among foldable smartphone owners who upgraded their phone in the past 12 months, 55% chose to go back to a traditional smartphone. . As consumers upgrade from better devices, retention rates also improve.

Apple remains a notable dropout from the foldable market, and given its foray into spatial computing with the Vision Pro, a new headset that retails for $3,499, it’s unlikely to launch next year. Apple’s foldable phone is sure to give the category a much-needed boost.

Kantar’s Worldpanel ComTech panel continuously tracks consumer behavior across the technology industry in 20 markets each month. Contact our experts to understand how data lead insights can help drive growth.

Source link