Top 10 European Tech Stocks to Invest In

The Forgotten Tech Scene

The world of tech stock is dominated by US tech giants, especially the “Big 7”: Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms.

Another big segment of the world tech industry is controlled by Asian companies, like Korean Samsung, Japanese Sony, and Taiwanese TSMC.

Nevertheless, the other largest economic pole, Europe, has quite a few tech champions of its own. And because it is less discussed and known, there is also a greater chance to find good bargains in these markets.

The European tech sector includes several world-class companies, internationally recognized brands, and leaders in their niche that most investors might not know are European.

Top 10 European Tech Stocks to Invest In

1. ASML Holding N.V.

The Dutch company is the sole manufacturer of EUV chip-making machinery. EUV (Extreme UltraViolet) lithography is the most advanced process for making computer chips and a must for the most advanced chips at 5nm and below.

The company has a de facto monopoly on this technology; It is also a leader in DUV (Deep UltraViolet), the previous generation of semiconductor manufacturing machines.

Source: ASML

This has made it a crucial part of the strategy of sanctions deployed by the USA to limit the development of the Chinese semiconductor industry. In the last few years, increasing levels of sanctions have been imposed on China, notably a ban on exporting EUV machines. These sanctions have also expanded to the most advanced DUV machines, in part due to the recent success of Huawei in producing advanced chips without EUV machines in September 2023.

So far, while Huawei and other Chinese firms have worked hard at bypassing the limitations & sanctions on EUV, this still represents a strong advance of ASML over its competitors.

The company keeps innovating and is also actively doing acquisitions of new key technologies, like Berliner Glas Group in 2020, allowing it to push for the next generation of chip-making machines.

ASML has grown its sales from €10.9B in 2018 to €21.2B in 2022, as well as its net income from €2.6B to €5.6B.

It is likely that the trade sanctions against China will somewhat hurt the company, as a lot of its sales were toward Chinese chip manufacturers.

With chip-making an increasingly strategic asset, it is equally likely that the push to bring back home at least some chip-making capacity, both in the US and the EU, will increase the demand for ASML’s machines for the next few years.

The growing demand for AI and computing, in general, is also very strong support for the company, with most advanced applications requiring the best 5nm or 3nm chips.

2. SAP SE

Besides American Oracle, the other major ERP software is the German SAP, with 280 million cloud users through 24,000+ companies. Both are competing in the same space but with somewhat different characteristics. While Oracle’s ERP is considered the most “powerful,” it is also more expensive and more complex, while SAP is often considered more secure.

Like many enterprise subscription services, SAP tends to have a very high retention rate of its clients and to grow the relationship over time, leading to increasing income from existing cohorts.

Source: SAP

Thanks to its Joule AI copilot system, SAP is not lagging behind AI either. It works as a virtual personal assistant, from generating job descriptions in HR to coding assistance.

Source: SAP

AI solutions are also available from SAP in sales, marketing, supply chain, procurement, and HR, all integrated with the other software to create a secure environment where to use generative AI.

There is likely space for more than one major player in deploying ERP and AI at scale at the enterprise level, making SAP one of the most promising European software companies, both for enterprise applications and AI.

3. Dassault Systèmes SE (DSY.PA)

French Dassault Systemes is part of the larger Dassault Group, a large aerospace, media, and defense conglomerate. Dassault Systemes’ initial products came from the need for more powerful software in aviation design.

The company expanded since the 1980s through the development of more powerful software and a long series of acquisitions of CAD and 3D software companies.

Today, Dassault Systemes covers many industries beyond aviation and defense, including urbanism/construction, life sciences, packaging, electronics, heavy industries, robotics, shipyards, and mobility (cars, trains, etc…).

What was historically an array of 3D software solutions specialized for each industry is progressively merging into one integrated solution called 3DEXPERIENCE. This unified environment allows for integrating VR/AR solutions, 3D modeling, manufacturing, and customer experience. It can also create a “virtual twin” of real-world components that can then be tested, experimented upon, or modified by other people more quickly and efficiently. In Q3 2023, 3DEXPERIENCE delivered a remarkable growth of 46% in software revenue.

Source: Dassault

Dassault Systemes software is an invisible layer of technology deeply embedded in the processes related to research, design, and manufacturing in all the most advanced industries, from aerospace to biotech and EVs.

The earnings per share grew by 20% in Q3 2023, and revenues are expected to grow by 8-9% in 2023. The long-established relationship with industrial partners, the critical mass of engineers trained and familiar with Dassault’s software, and the quality of the products make for a hard-to-beat competitive moat. With the emergence of 3D printing, IoT, and the so-called 4th industrial revolution, Dassault is in a position to keep growing and deliver good returns to its shareholders.

4. AutoStore Holdings Ltd. (AUTO.OL)

Autonomous vehicles like self-driving cars might be around the corner, but they have been a difficult technology to develop, even for tech leaders like Google and Tesla. But there is a sector that is already getting revolutionized by autonomous driving and robotics, which is logistics.

The Norwegian AutoStore provides automated warehouses for industries as diverse as pharmaceutics, clothing, groceries, aviation, logistics, or industrial manufacturers. Apparel, industrial, and third-party logistic companies make up the 3 largest segments of AutoStore’s business.

Source: AutoStore

The company warehouses rely on autonomous robots that can identify, pick up the parcels or products, and carry them to where they should go autonomously. You can see them in action in this video.

The company is quickly expanding, thanks to more and more major companies realizing the advantage of creating more efficient, resilient, and quicker logistical systems after the pandemic. On average, it takes only 1-3 years for the upgrading to autonomous warehouses to pay back the initial investment.

AutoStore is active in 50 countries, operating 58,500 robots for 900 different customers. It grew its revenues by 50% CAGR since 2017. This is 2-3x quicker than the automated warehouse market yearly growth, estimated at 15%.

Like many European tech companies, AutoStore provides very advanced solutions that are also somewhat invisible to the greater public.

Most warehouses will move toward automation. Leaders in this sector are likely to outperform the sector growth, as it makes sense to rely on the provider able to deploy these solutions at scale and at a cheaper price. Once adopted, it is unlikely for a company to switch to another provider, as it would require a complete redesign of the warehouse, changing the robot fleet, etc. So, the current quick growth is likely to convert into recurring revenues for many years, if not decades.

5. STMicroelectronics N.V.

When speaking of the semiconductor industry, the dominant region that comes to mind is Asia, with most microchips and computer components built and assembled in the region.

But for other sectors equally requiring semiconductors, Europe is a key supplier, with STM one of the leading companies of the continent. It is active in mobility (EVs and automotive digitalization), power and energy (especially renewables), as well as sensors and IoT (Internet of Things) systems. The company is also active in small electronics, with smart chargers, AR/VR displays, gaming controllers, and robotic toys.

Source: STM

STM activity is, for now, driven by its core businesses in personal electronics and industrial applications. But EVs (including silicon carbide), automation, and AR/VR are areas of high growth expected to grow its markets by $8B.

Source: STM

STM is not producing ultra-advanced 5nm chips like TSMC. Instead, its components are integrated into all the key digital devices in less central but not less vital parts of EVs, small electronics, and automation/robotics like sensors, micro-controllers, and power management.

This allowed STM to grow with the semiconductors industry as a whole, with revenues growing 10% CAGR since 2018 and generating high gross margins in the 36-42% range since 2016.

STM’s main limitation currently is its semiconductor foundry ability, with $3.6B in capex investment in 2022 for new or expanded factories in Canada, Singapore, France, and Germany.

The company is trading cheaply compared to its earnings, with a P/E below 10. This reflects how semiconductor companies out of Asia have been somewhat “forgotten” by the speculative enthusiasm around more geopolitically important companies like TSMC, ASML, and NVIDIA. It is also an opportunity, as this pricing might not reflect the growth prospects of STM.

6. Spotify Technology S.A.

The Swedish company is the leader in audio streaming, with by far the largest music catalog (100 million tracks), making it the go-to application for music lovers worldwide.

The company is also a place where users can find 5 million podcast titles and 350,000 audiobooks. It has 574 million users, including 226 million subscribers in 184 markets.

Spotify is now a household name, but it is easy to forget that it single-handedly managed to stem the issue of music piracy of the early 2000s by providing a seamless streaming experience that users were ready to pay for while illegal but free alternatives existed.

The user base keeps growing, with year-to-year growth of 26% in monthly active users in Q3 2023 and a 16% growth of active subscribers. The company generated €216M of free cash flow in Q3 2023 from €3.3B in revenues.

Source: Spotify

While at the core of Spotify’s offering, the music segment is not very profitable due to high payment to the music rights holders stemming from historical deals signed early in Spotify’s history, including with all the major music labels. So, the company has been looking at podcasts to push its advantage on audio content.

A part of this push toward podcasts has been signing mega-deals with some of the most popular podcasters, like Joe Rogan, with varying levels of success. Original content creation has been tried as well, with limited success. This also included unique services like an automated translation of podcasts in a new language, duplicating the original podcaster’s voice.

Overall, the podcast is still a troubled segment for Spotify, with Alphabet’s YouTube and Apple still leading in terms of popularity and total downloads. Similarly, audiobooks are still dominated by Amazon’s Audible.

Investors in Spotify will want to assess if the company can convert its massive and quickly growing user base into leadership in new segments like podcasts or audiobooks. This is far from done, but it could also work, especially considering the growing backlash over anti-competitive practices and abuse of content creators by YouTube or Audible.

7. Telefonaktiebolaget LM Ericsson (publ)

Swedish Ericsson is a leader in telecommunication technology, especially 5G. The company is also an important provider of connected solutions, network services, and automation.

Source: Ericsson

50% of 5G traffic outside of China is established through the Ericsson radio network, and 16 out of 20 of the largest communications service providers have chosen Ericsson technology. Ericsson controls 39% of the global RAN (radio access network) market, excluding China.

This impressive result is thanks to a massive R&D effort initiated in 2017, after a period where the company’s technology had started to lag behind, yielding more than 60,000 5G-related patents.

The company has seen its sales decline slightly from 2022 to 2023 (-5%) due to a decline in network sales, partially offset by growth in the cloud, enterprise, and services segments. It also registered an impairment of SEK 31.9B ($2.85B).

The recent stagnation in sales has been attributed to a challenging macroeconomic environment, marked by slower-than-expected 5G deployment, inflation, and reduced investment due to rising interest rates.

While the recent slowdown in sales is disappointing, it does not change the technological and commercial advantage of Ericsson in 5G technology.

With this technology becoming the base of future connectivity, as well as being required for AR/VR (Augmented and Virtual Reality) and IoT (Internet of Things) applications, this should ensure continued business for the company for years to come, especially once the current economic shock from high-interest rates has passed. In the meanwhile, Ericsson’s shareholders can collect a pretty solid dividend above 5%.

8. Logitech International S.A.

Logitech is one of the largest companies in computer accessories, like keyboards, mice, webcams, and headsets. It controls 53% of the market share in pointing devices (laser pointer), 49% in keyboard and combos, 30% in gaming accessories, and 28% in video conference/webcam.

Source: Logitech

The company benefits from a stellar reputation with gamers for its sturdy and high-quality devices. Logitech’s sales exploded during the pandemic and are still at a much higher level than in 2020 (50% higher). The market might be durably larger, thanks to the rise of remote and hybrid work, as well as the growth of the videogame market.

Source: Logitech

Logitech was a market darling in the heart of the pandemic, seeing its stock price rising from $39/share in February 2020 to $120/share in May 2021. It subsequently fell to $46 in September 2022, rebounding at $78 in November 2023.

Considering the brand quality and market growth from changing consumer habits, the post-pandemic crash was clearly excessive. With the current rebound in share price, the company is probably fairly priced, representing a good opportunity to buy a leading electronic company at a reasonable price.

9. Wise plc (WISE.L)

Wise (formerly TransferWise) is an Estonian startup initially founded to facilitate cross-border money transfers while dramatically reducing the often outrageous fees banks charged for this service. This represents a total market of £2T for individuals and £9T for SMEs.

The company claims to be able to do international and multi-currency money transfers in less than 20 seconds for 8-10x cheaper fees than banks.

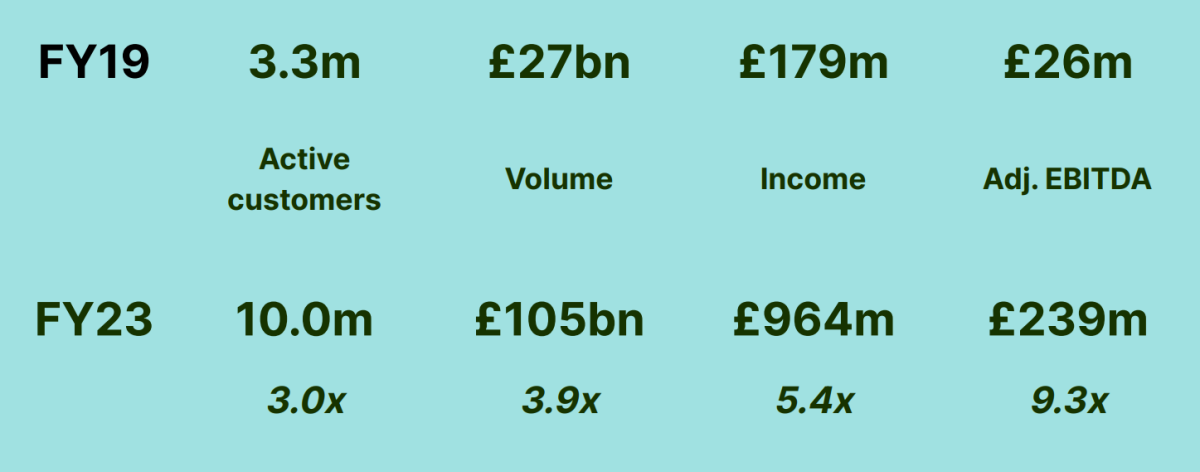

Since 2019, the company has multiplied its customer base by 3x, reaching 10 million people, and its income and EBITDA grew even more.

Source: Wise

This still leaves much room to grow for Wise, with only a 5% share of the personal market and 1% of the SME market.

A very impressive statistic from Wise is that 66% of its customers came from word-of-mouth, which Wise calls “evangelical customers,” an almost unheard-of performance in finance, where customer acquisition can be expensive.

This is most likely due to the exceptional performance in both speed and fees. The volume of transfers from existing customers also tends to grow over time.

Source: Wise

Wise is now profitable and listed on the London Stock Exchange. Wise’s business is somewhat niche, not trying to compete on trading fees, loans, and other larger financial industry sectors.

It is also responding to a very real need that has been neglected (abused?) by banks, with an infrastructure for money transfers that had not evolved for decades.

So investors in the company will aim for Wise to have developed a strong economic moat and brand and the ability to expand it globally beyond the US+EU region.

10. CD Projekt S.A. (OTGLY)

Initially, a very small Polish developer, CD Projekt Red grew with its core license: The Witcher series. Launched in 2007, it brought to video game the popular, but somewhat unknown in the West, “Witcher” fantasy story from Polish author Andrzej Sapkowski.

The series’ popularity with RPG (Role Playing Game) fans grew with each iteration. The Witcher 3 was the great breakthrough for CD Projekt, ranking as the 10th most-sold video game in history and 2nd best-selling RPG behind Red Dead Redemption 2.

Source: The Witcher

The game was followed by a massive DLC acclaimed by fans as the “Best DLC in history” for its scale and quality. The Witcher would receive a high-budget Netflix series adaption, which would go on for 3 seasons.

It is crowned with this stellar and well-deserved reputation that CD Projekt announced a new license, Cyberpunk 2077, promising to be a science-fiction version of The Witcher, except bigger and better. The initial release, struggling with bugs, questionable design choices, and a botched port to PS4 damaged the company’s reputation, especially considering how high the standards and expectations had been set.

Since then, CD Projekt has worked on fixing Cyberpunk 2077 (Steam reviews are back to 80% positive), repairing its reputation with fans, and launching new ambitious projects. The animated show Cyperpunk Edgerunner is also the highest-rated show ever on Netflix, rebuilding enthusiasm for the license and its universe.

CD Projekt is working on a new Witcher trilogy, remakes of the earlier and dated Witcher 1 & 2, a multi-player Witcher game (Project Sirius), as well as Phantom Liberty (offshoots of Cyberpunk 2077) and Orion (essentially Cyperpunk 2).

Source: CD

The stock of CD Projekt is yet to recover from the poor reception of Cyberpunk 2077. Still, the success of the Netflix series, the recovery of Cyperpunk 2077 rating, and the eager wait for the new releases show that CD Projekt still holds a lot of goodwill with gamers. It also demonstrates the value of its IPs, which are yet to be monetized into movies or other product lines fully.

So CD Projekt Red stock is for investors willing to take a risk and interested in a quality stock selling at a (temporary?) discount with strong growth potential.

Source link