In a slow year for enterprise technology M&A, there were few notable deals.

Image credits: Nazan Akporat/Getty Images

It’s time to take a look back at this year’s biggest tech M&A deals. Typically, by this point, the usual acquisition suspects like Microsoft, Salesforce, Adobe, SAP Oracle, and Cisco have undergone at least some major changes. But this year, only Cisco made a big splash, ultimately announcing 11 deals in total.

SAP has made some small deals, but Microsoft, Salesforce, Adobe, and Oracle have been mostly quiet this year. The $61 billion Broadcom-VMware deal, announced in May 2022, was finally completed last month, and Adobe and Figma agreed this month to terminate the $20 billion deal, which ends in September 2022. It has been a regulatory impasse since it was announced in September.

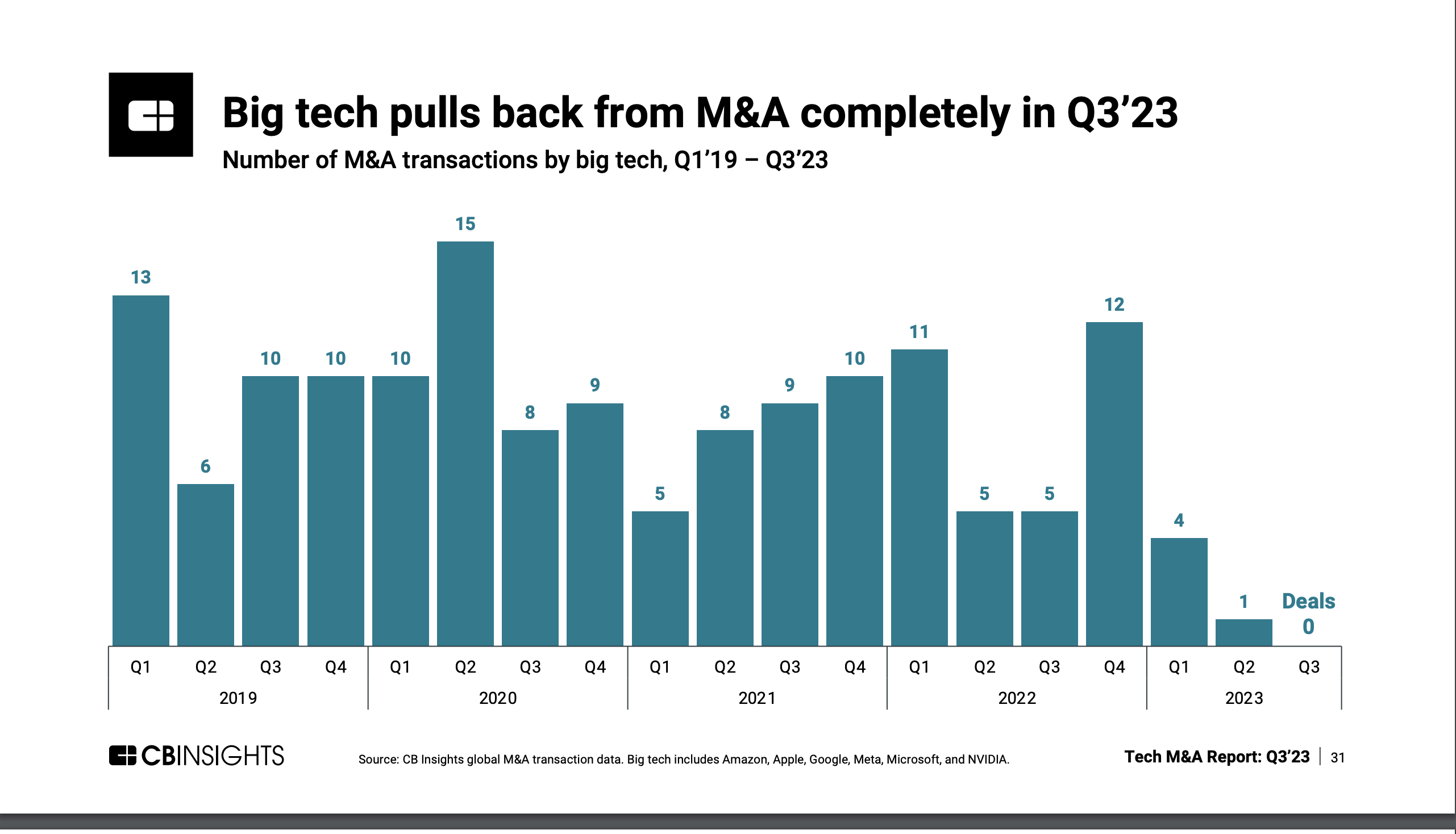

It is not our imagination that transactions from major companies are decreasing. CB Insights reported zero deals from Big Tech in the third quarter of this year. Compare that to 2019, when he had 10 such trades in the third quarter, and 2020, when he had eight.

Image credits: CB Insight

Perhaps high borrowing costs put a damper on deals in 2023. The days when his major deals totaled $165 billion in 2020 are long gone. This year’s total was just $67.7 billion, the lowest total since a record low of $40 billion in 2019, the second year the list of these top deals was compiled.

It’s worth noting that a significant number of this year’s deals involve private equity firms acquiring companies or selling them at significant profits.

Perhaps smaller deals involving AI were more important, like Atlassian’s $975 million acquisition of Loom. Salesforce acquired Airkit.ai for an undisclosed sum, one of just two small acquisitions this year. Or Snowflake’s acquisition of AI search company Neeva, again for an undisclosed sum.

Regardless, here are this year’s top 10 corporate deals, from cheapest to most expensive.

Databricks acquires MosaicML for $1.3 billion

This year has been about large-scale language models and generative AI. Databricks acquired MosaicML, a large language model development company, for $1.3 billion as it looks to focus its data platform on AI.

IBM acquires Software AG’s StreamSets and webMethods for $2.3 billion

As the year draws to a close, IBM once again committed to expanding its hybrid cloud support services, acquiring several products from Software AG, a German enterprise software company owned by private equity firm Silver Lake. Silver Lake recouped a significant portion of her $2.6 billion investment in Software AG with this sale.

TPG acquires Forcepoint Security for $2.4 billion

This may not have been the most exciting deal of the year, but it was still a multi-billion dollar deal. Private equity firm TPG has acquired Forcepoint Security’s government security division from Francisco Partners for $2.4 billion.

Vista Equity acquires Duck Creek for $2.6 billion

In another private equity venture, Vista Equity Partners acquired insurance technology suite vendor Duck Creek Technology for $2.6 billion, making it a SaaS vendor with a strong niche in the insurance industry. The company went public in 2020, but ultimately sold it at a 45% premium.

Thales Aerospace acquires Imperva for $3.6 billion

French aerospace company Thales has acquired security company Imperva from private equity firm Thoma Bravo for $3.6 billion. Thoma Bravo acquired Imperva in 2018 in a $2.1 billion deal, meaning it held the company for five years before making a profit of $1.5 billion.

Clearlake Capital takes Alteryx private for $4.4 billion

Alteryx is a data processing company that went public in 2017 with $1.4 billion (according to Crunchbase), but was acquired by Clearlake Capital in a $4.4 billion deal at the end of the year, taking the company private.

IBM acquires Apptio for $4.6 billion

As IBM continues its transition to a hybrid cloud management vendor, the company acquired Apptio from Vista for $4.6 billion. Apptio helps you manage data in hybrid systems on-premises and in the cloud. This is becoming increasingly important in an AI-driven world. Vista he acquired Apptio in 2018 for 1.94 billion. This equates to an impressive $2.7 billion profit for him over the original price.

Francisco/TPG acquires New Relic for $6.5 billion

New Relic once represented a new generation of application performance management software companies, but as SaaS has fallen in value in recent years, it has become a target of two private equity firms. New Relic was sold earlier this year to Francisco and TPG (two of his names we’ve already seen in other deals on this list) for $6.5 billion.

Silver Lake Partners and Canada Pension Fund acquire Qualtrics for $12 billion

In the strange story of Qualtrics, the company (once a fast-growing startup) was sold to SAP for $8 billion in 2018. The company was spun out just 20 months later and went public in 2021 before being taken private again in June by a consortium that included Silver Lake Partners for $12 billion. It’s been quite a journey.

Cisco acquires Splunk for $28 billion

The biggest deal so far this year is with Cisco, which has been on a buying spree. But while the company often makes small acquisitions, it rarely, if ever, makes acquisitions as large as the one it announced in September that it would buy Splunk for $28 billion. It was a huge deal, and in a year where there were no big deals, it was alone at the top of the mountain.

Source link