Top 10 Tech Stocks For 2024

Just_Super

Technology is on track for its best year since 2021, as shown by its price performance below, tracked using the Technology Select Sector SPDR ETF (XLK). Driven by seven of the most significant stocks in the market, tech’s terrific bounce-back from 2022 marked a stellar rebound amid a year of changes and groundbreaking advancements. Although past performance does not guarantee future results, this year’s tech stocks reflect some of the best Quant ideas from early February, as highlighted by their Quant Strong Buy rating.

The Technology Sector (XLK) rallies through year-end

The Technology Sector (XLK) rallies through year-end (SA Premium)

Year In Review: 2023 Tech

The macro and geopolitical headwinds of 2023 affected industries worldwide, with the rapidly evolving tech industry needing a boost from 2022 drawdowns. The ripple effect of Silicon Valley Bank’s collapse, preceded by the multi-billion-dollar collapse of crypto exchange FTX, sent shockwaves through the industry. When you factor in inflation-related setbacks and controversies surrounding privacy and ESG regulations, tech has experienced volatile price swings over the last few years.

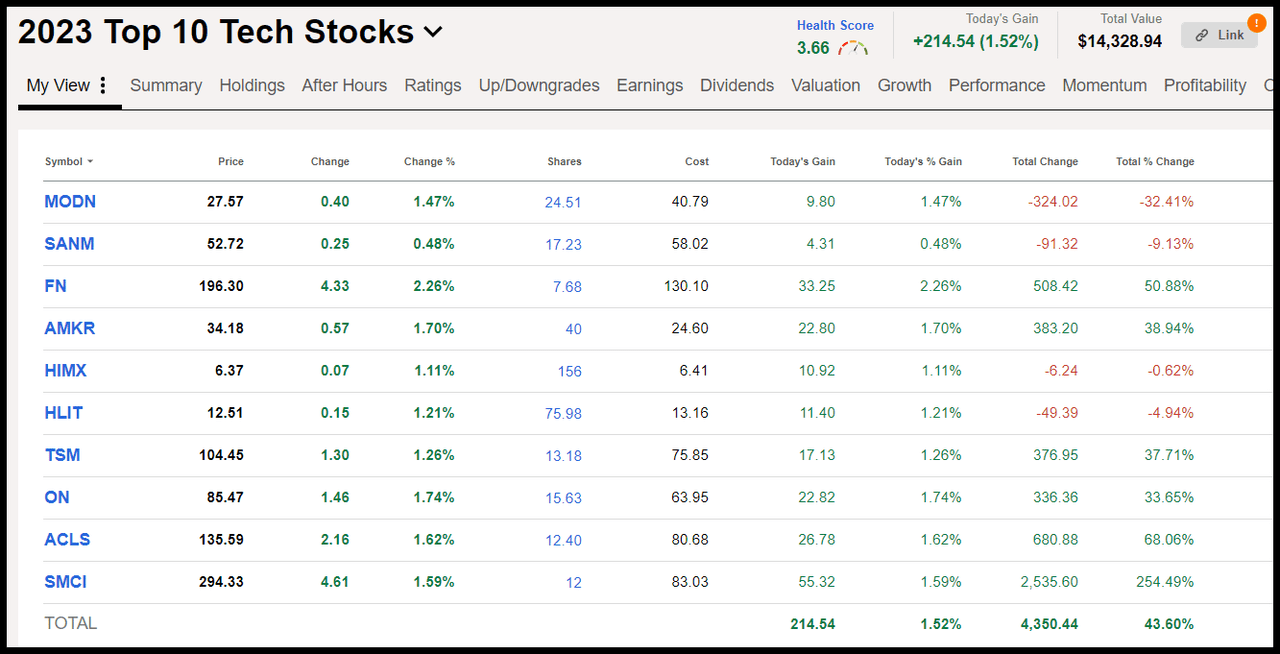

However, groundbreaking advancements through artificial intelligence have aided the efficiency and productivity of some companies, serving as growth drivers. In addition to SA Quant’s Top 10 Tech Stocks for 2023, which outperformed the S&P 500 by nearly double through year-end, SA Quant is offering a new list of tech stocks for 2024. In 2023, the SA Quant Team’s portfolio of 10 tech stocks outperformed the S&P 500*, which included (SMCI) up 255%, (ACLS) +68%, and (FN) +50%.

2023 Top 10 Tech Stocks Portfolio (SA Premium)

When selecting growth or tech stocks in a rising rate environment, to screen for stocks, the SA Quant Model will identify stocks with strong fundamentals based on five key factors: Valuation, Growth, Profitability, Momentum, and EPS Revisions. Notably, the market cap weighted Technology Select Sector (XLK) was up 54.68%, outperforming the 2023 Top 10 list. However, XLK has tremendous concentration risk; its top 10 stocks in the index account for almost 70% of the holdings. Furthermore, the top two stocks in the ETF account for 43.40% of the holdings.

Rather than focusing on the Big Techs that have dominated major index performance and can be considered overvalued, the SA Quant Team’s top stocks list is unique, offers diversification into various tech industries, and may benefit from a rotation out of some of the largest market cap tech stocks. As the demand for automation, ChatGPT, and cutting-edge AI solutions shape businesses, let’s explore how these advancements help drive tech sector growth.

Artificial Intelligence (AI) & ChatGPT Driving Tech Sector Growth in 2024

AI and ChatGPT trends are evolving, and some of the most prominent tech constituents known as the Magnificent Seven stocks: Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA) are capturing market share by capitalizing on AI as a revenue generator. The World Economic Forum (WEF) estimates that nearly 85 million jobs could be displaced by 2025 as companies focus on AI and machine learning trends.

“Globally, organizations are adopting generative AI in a purposeful and responsible manner, propelling workforce transformation and cultivating a culture that nurtures agility, resilience, and competitiveness,” says Greg Brown, President and CEO at Udemy (UDMY). “Cutting-edge solutions powered by generative AI have endless potential. At Udemy, we are excited to empower corporations with courses and curated learning paths on emerging skills and lead the transformation to a skills-based economy in this ever-evolving landscape.”

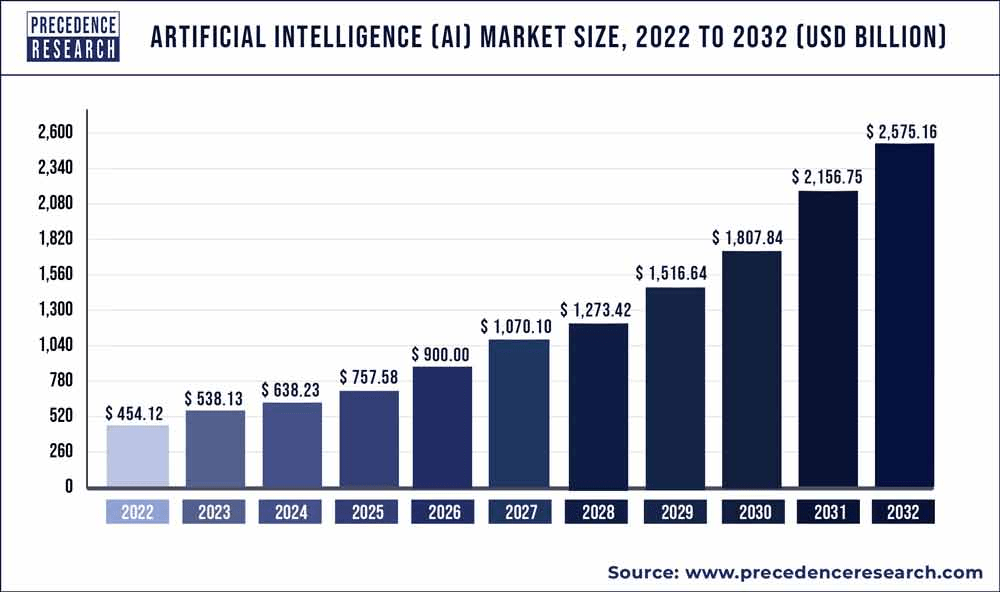

The developments and unleashing of generative AI globally are projected to reach $2.5 trillion by 2032, a CAGR of nearly 20%.

AI Market Size (2022-2032) (Precedence Research AI Report (10/2023))

According to Precedence Research, AI-related revenues could grow 4-5x from 2022 to 2032 across several industries, including financial, healthcare, media, automotive, and manufacturing. With multiple service offerings and applications in the mix, including cloud, on-premise hardware, and software, consider the SA Quant Team’s top 10 tech stocks for 2024 as the marketplace and demand for AI increase.

Top 10 Tech Stocks for 2024

The top 10 tech stock list for 2024 is packed with stocks that have solid momentum, growth, profitability, and EPS Revisions Factor Grades. Although the SA Quant Team’s top ten tech stocks are effective from February 9th, we want to highlight historical performance. Over the past 12 months, each of these ten stocks for 2024 is up, on average, over 130%, led by Super Micro Computer (SMCI) (+765%), SA Quant’s #1 stock pick for 2023, Celestica Inc. (CLS) (+181%) and Salesforce, Inc. (CRM) (+70%). Seven of the stocks have double-digit forward EBITDA growth and strong sales metrics.

Top 10 Tech Stocks for 2024 – Strong Momentum, Growth, and Profitability (as of 2/13/24)

This exhibit was updated on 2/13/24. The previous exhibit erroneously displayed BASE and that is not part of the Top 10 Tech Stocks. The missing stock in the exhibit was PATH. PATH is in the article at #9 (as of 2/13/24) (SA Premium)

The portfolio is diversified across product and service offerings and covers multiple tech industries that include: Tech Hardware Storage and Peripherals, Application Software, Electronic Manufacturing Services, Internet Services & Infrastructure, and Semiconductor offerings. Additionally, the portfolio consists of large-cap, mid-cap, and small-cap stocks.

1. Super Micro Computer, Inc. (SMCI)

-

Market Capitalization: $38.24B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 1 out of 551

-

Quant Industry Ranking (as of 2/9/24): 1 out of 26

Super Micro Computer (SMCI) is a one-stop-shop Total IT solutions that offers cloud infrastructures, hardware, and advanced storage systems for key players like Nvidia, wanting to capitalize on artificial intelligence. SMCI was also selected in 2023 by the SA Quant Team as a Top 10 Tech Stock and the #1 overall stock pick.

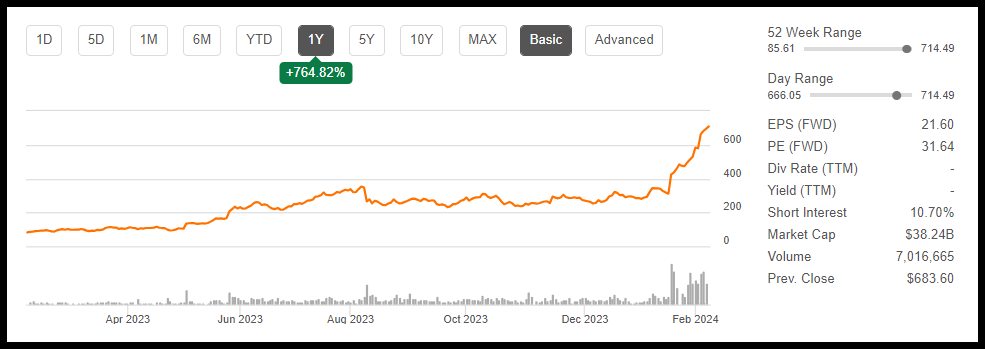

SMCI Stock’s 1-Yr Price Performance

SMCI Stock’s 1-Yr Price Performance (SA Premium)

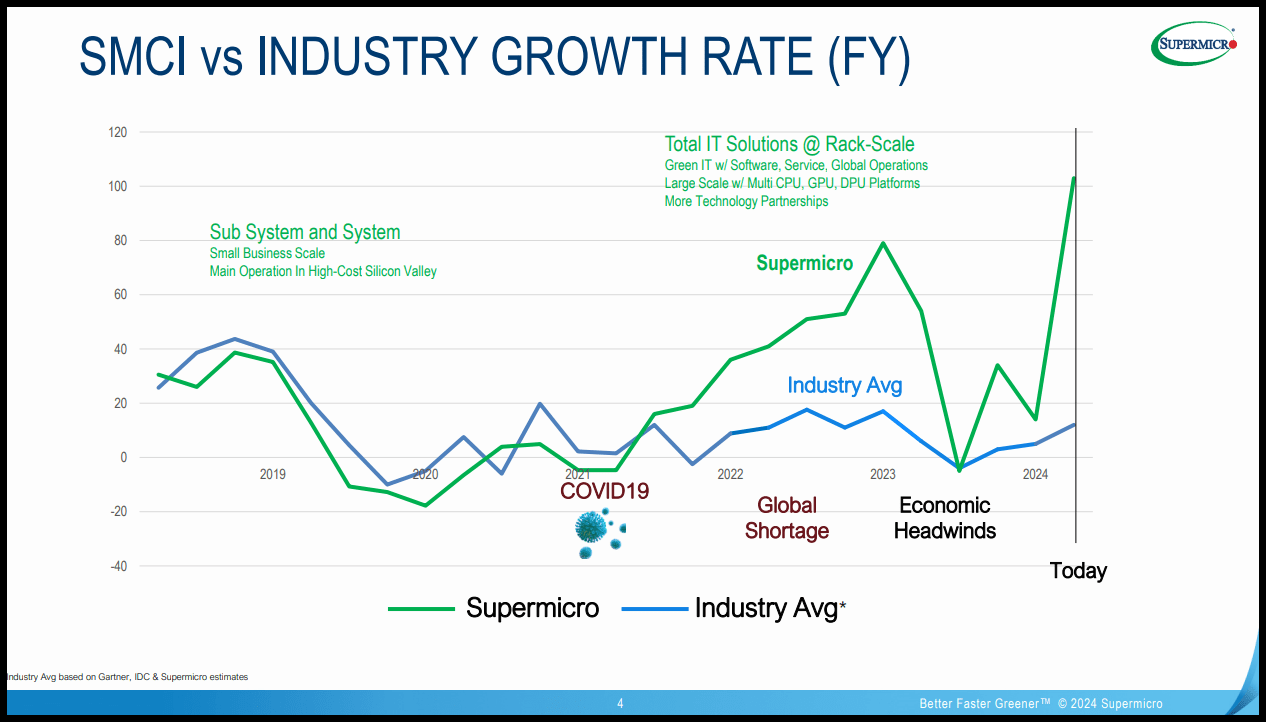

Super Micro’s 765% price surge over the last year has been nothing short of amazing. Supported by tailwinds from record demand for AI systems at rack scale and Next Gen AI designs, SMCI has consecutively beaten top-and-bottom-line earnings and showcases a growth rate nearly 5x the industry average.

SMCI vs. Industry Growth (SMCI FYQ2’24 Investor Presentation)

Targeting a $25B annual revenue goal, SMCI is focused on the future. Having produced Q2 2024 EPS of $5.59, beating by $0.43, and record revenues of $3.66B, beating by more than 103%, according to a Wall Street analyst Mehdi Hosseini, Super Micro’s all-time high is still in the “early innings of adoption,” as guidance continues to impress.

2. Salesforce, Inc. (CRM)

-

Market Capitalization: $282.61B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 3 out of 552

-

Quant Industry Ranking (as of 2/9/24): 1 out of 191

As measured by global revenue, Salesforce, Inc. is the #1 provider of Customer Relationship Management (CRM) software, rated as one of the world’s most admired companies, and is the top SA quant-rated Application Software stock. Salesforce’s technology helps clients leverage customer data to track sales, monitor leads, forecast opportunities, and generate analytics. Recent trends indicate a faster AI adoption cycle for Salesforce office tools than Microsoft (MSFT) 365 CoPilot.

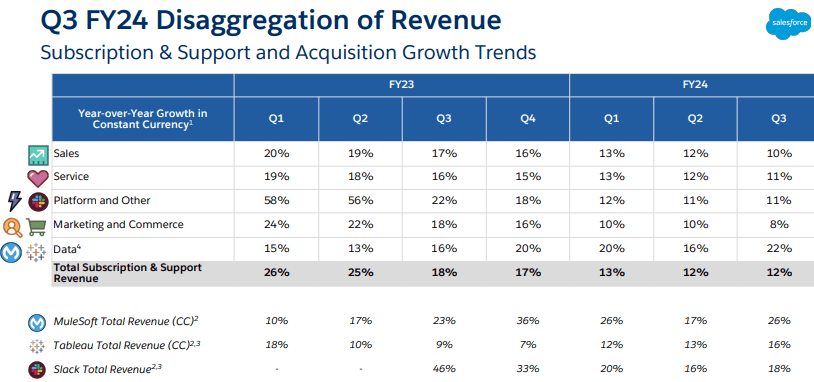

Up more than 70% in the past twelve months, Salesforce stock surged 9% in November after reporting stellar FQ3 2024 results. Third quarter EPS of $2.11 beat by $0.05, and revenue of $8.72B beat by more than 11% YoY. Salesforce posted consecutive year-over-year double-digit revenue growth for Q3, with its data division seeing the most significant percentage growth in sales. The data division was up 22% YoY, driven by the MuleSoft (+26%), Slack (+18%), and Tableau (+16%) applications.

Salesforce Q3 FY24 Revenue Figures (CRM Investor Presentation)

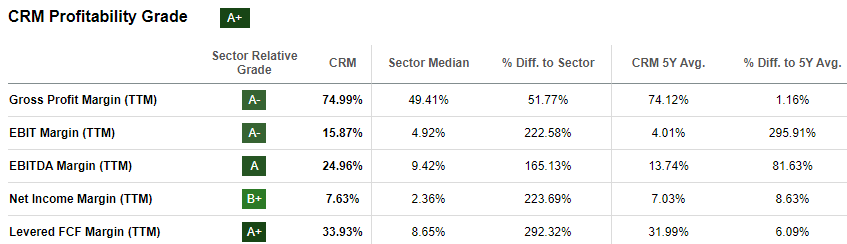

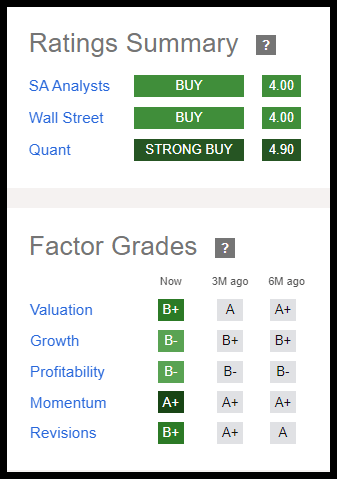

Salesforce’s solid performance and high expectations have earned it a 4.97 Quant Rating based on grades across five key factors: valuation, growth, profitability, momentum, and earnings revisions. CRM has an A+ Profitability Grade and has delivered high-margin growth over the past five years, with gross profit margins averaging 75% and levered FCF margins at over 30%.

CRM Stock Profitability Grades (SA Premium)

Salesforce’s year-over-year EBITDA Growth surged by over 100%, and EPS increased by an astounding 850%. Forward sales and profitability growth metrics look strong, with EBITDA FWD at 19% and long-term EPS at a CAGR of about 24%. Salesforce has an eye-popping 46 up revisions in the past 90 days and only one down revision. Despite its ‘D’ Valuation Grade, CRM offers an attractive forward PEG ratio of 1.45x versus 2.04x, nearly 30% below the sector. CRM’s robust growth, high profitability, and favorable market trends make Salesforce one of the most attractive investments in technology, along with my next pick.

3. Celestica, Inc. (CLS)

-

Market Capitalization: $4.47B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 14 out of 552

-

Quant Industry Ranking (as of 2/9/24): 1 out of 17

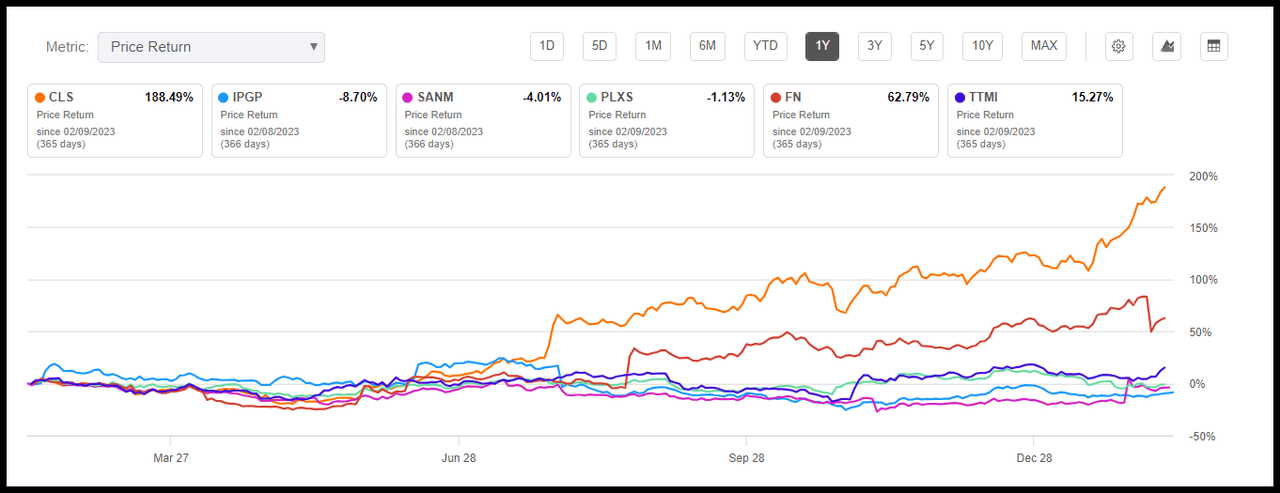

Celestica, Inc. (CLS) is the top Quant-rated stock in the electronic manufacturing services industry, crushing the market and its peers. Up more than 188% in the past year, Celestica provides a wide range of high-tech supply chain solutions and product manufacturing services.

CLS Stock outperforms the market and its peers

CLS Stock outperforms the market and its peers (SA Premium)

CLS Q3 revenue growth was driven by strength from hyperscaler customers supporting artificial intelligence applications. Hyperscale technology and data centers are designed to help scale and support next-generation high-performing hardware. As economies change and there is a need to accelerate designs and the production of innovative technologies, CLS benefits from Big Data partnerships and companies demanding solutions for ever-evolving technology. CLS has a Quant Strong Buy rating with an overall quant score of 4.90 and excellent Factor Grades and receives buy ratings from Seeking Alpha and Wall Street Analysts.

CLS Stock Quant Ratings and Factor Grades (SA Premium)

CLS’ projected growth looks strong, with revenue growth forward at 9%, EBITDA at 25%, and EPS at 29%. In Q3, CLS revenue of $2.04 billion was up 6.24% YoY, and EPS of $0.65 beat by $0.05. Over the last year, CLS is up more than 185%. Celestica’s valuation metrics remain strong, with a forward P/E ratio 42% below the sector median and forward EV/EBITDA 51% below the sector median.

4. Twilio Inc. (TWLO)

-

Market Capitalization: $12.74B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 12 out of 552

-

Quant Industry Ranking (as of 2/9/24): 5 out of 24

Year-to-date, the Communications Sector has been the top performer. Twilio, Inc. is a cloud-based software and communications solutions company enabling developers to integrate voice, messaging, and email interactions into customer-facing applications. Showcasing a Quant Strong Buy rating of 4.91, Twilio is up 15% in the past year and is scheduled to announce earnings on February 14th. Twilio has posted 18 consecutive quarterly earnings beats, including Q3 EPS of $0.58, beating by $0.22, and revenue of $1.03B, beating by $44.21M. Forward EBIT growth is over 500%, and the company’s full-year Non-GAAP income from operations was revised up from $475M to $485M.

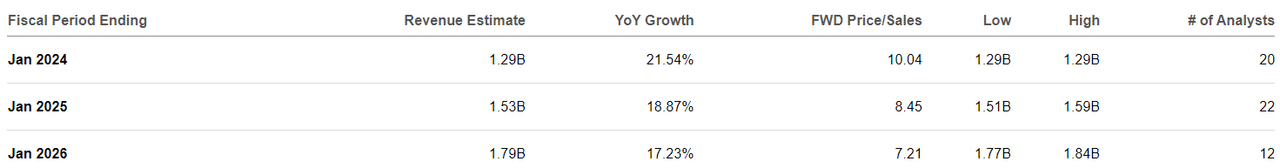

Twilio Stock Revenue Estimates

Twilio Stock Revenue Estimates (SA Premium)

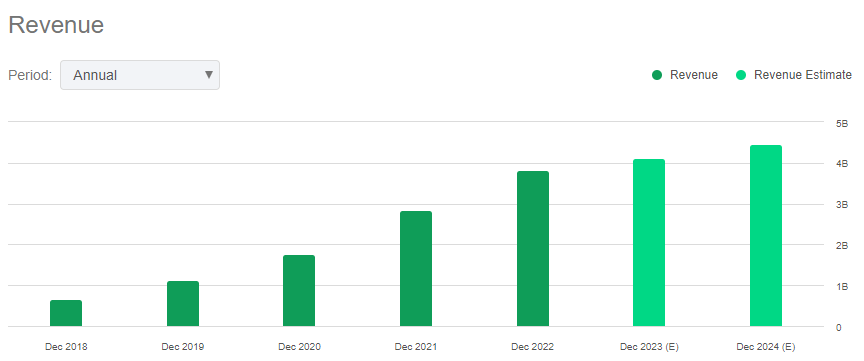

In addition to growing revenue 5.8x from $650.07 million in 2018 to $3.83 billion in 2022, Wall Street Analysts hold a solid outlook. With only one downward revision and 31 Fiscal Year Up Revisions over the last 90 days, consensus estimates have the company reaching $4.12 billion in 2023 and $4.5 billion in 2024. In addition to strong growth and momentum, as highlighted by the Quant Grades, Twilio trades at a discount. Forward EV/Sales of 2.45x versus the sector’s 2.92x help drive a B- quant factor grade, and its forward PEG of 1.08x is 47% below the sector median. After positive guidance in a January 8th announcement by new CEO Khozema Shipchandler, the company plans to cut expenses and helped develop a new strategic plan to enhance Twilio’s focus and execution.

“As I step into the CEO role, I am focused on continuing to build on the considerable growth and operating improvements we’ve made across the board, plus taking a fresh look at the areas of the business that are underperforming to realize the full potential of our business.”

5. Fabrinet (FN)

-

Market Capitalization: $7.12B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 42 out of 552

-

Quant Industry Ranking (as of 2/9/24): 2 out of 17

A global leader in advanced precision optical and electronic manufacturing services with factories in Thailand, China, Israel, and the U.S., Fabrinet serves growing markets, including telecom and optical communications, automotive, industrial lasers, and medical components. Fabrinet optical communications sales comprise nearly 70% of total revenue, rising 7.2% in the most recent quarter due to an uptick in artificial intelligence applications. Overall quarterly revenue was up 4.58% YoY to $685.48 million, and EPS of $200 beat by $0.14. Based on consensus estimates, revenue and profits are expected to grow about 8% in 2024 and 2025, and the stock is up 60% in the past 12 months.

Fabrinet Stock 1-Yr price performance

Fabrinet Stock 1-Yr price performance (SA Premium)

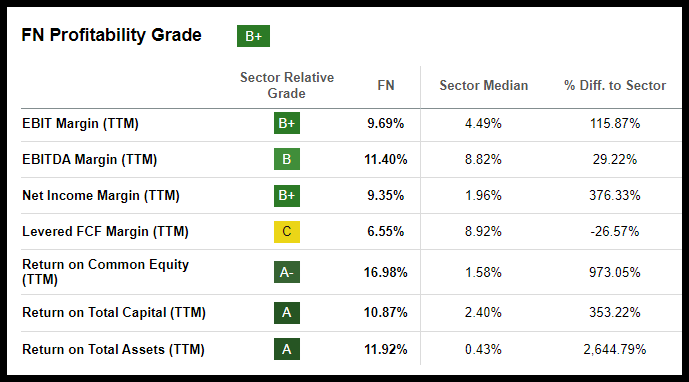

FN has a B+ profitability grade highlighted by net income margin of 9%, ROE of 17.5%, and return on capital of 11%, +284% over the sector median. The strong ROTC metric indicates the effective deployment of overall capital.

FN Stock Profitability Grade (SA Premium)

FN secured a B- growth grade largely due to a lack of capex growth versus the sector, but key historical and forward growth metrics are in double-digits, including sales, EBITDA, EBIT, and EPS, with operating cash flow growth at over 100%. FN’s balance sheet is strong with D/E at less than 1%, cash flow positive, and operating margins of 231x interest payments. The company’s consistent growth, solid deployment of capital, and strong balance sheet drive its ability to make the cut of SA Quant’s 2024 top ten tech list.

6. GoDaddy Inc. (GDDY)

-

Market Capitalization: $15.89B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 21 out of 550

-

Quant Industry Ranking (as of 2/9/24): 8 out of 24

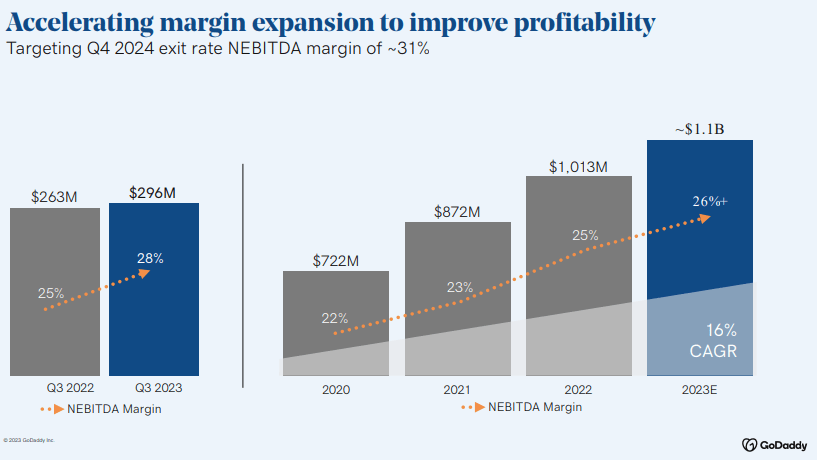

GoDaddy Inc. is an Internet and Infrastructure company riding the generative AI wave. Well known as a source for website domain registrations and development tools, GoDaddy also offers a Smart Terminal, which offers an all-in-one system for managing in-store inventory, product catalogs, and payments. In 2024, the company launched GoDaddy Airo, an AI-powered integrated tech platform. The stock rose almost 40% in the past year, with a huge bounce in the past 2.5 months after reporting solid Q3 earnings highlighted by margin expansion and improved top-line growth. GDDY is expected to announce Q4 earnings on February 13th. GDDY’s fast-growing high-margin segment applications and commerce bookings grew 12% in Q3. Revenue of $1.07 billion beat by $4.91 million, and EPS of $1.48 beat by $0.51.

GoDaddy Stock Expands Margins (Q323 Earnings Presentation)

GoDaddy has posted quality margins in the trailing four quarters with EBIT at 13% and levered FCF margin at an impressive 8%, for an A- factor grade. Although the stock is trading at a 52-week high and showcases a ‘D’ Quant Valuation Grade, some of its underlying valuation metrics are attractive, and given its growth outlook and tailwinds from generative AI, Citi raised its price target calling the stock a “significant opportunity.”

7. Photronics, Inc. (PLAB)

-

Market Capitalization: $1.98B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 23 out of 552

-

Quant Industry Ranking (as of 2/9/24): 1 out of 29

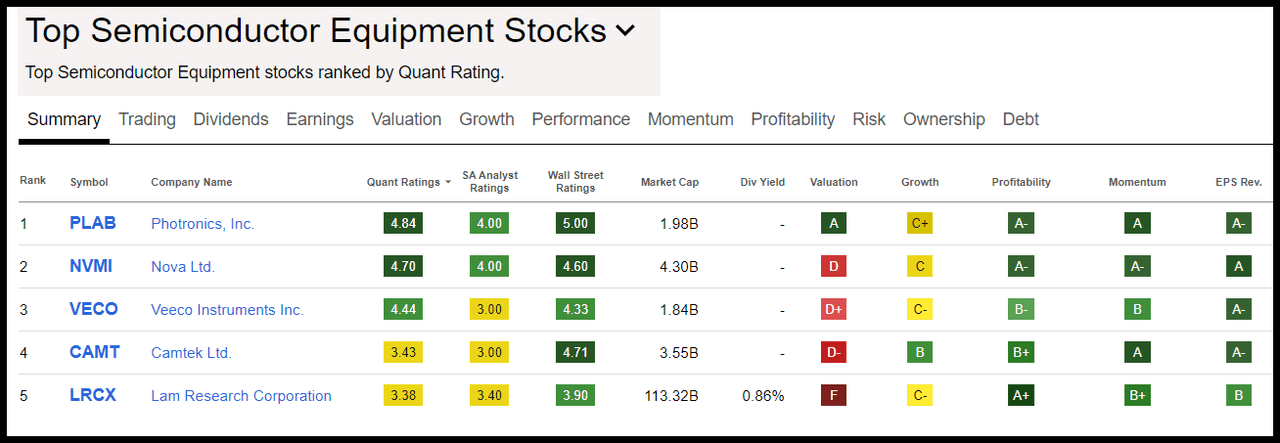

Photronics, Inc. manufactures photomasks for integrated circuits and flat panel displays. PLAB is number one on SA’s list of quant-rated Semiconductor Equipment Stocks with a 4.84 Strong Buy rating driven by A’s in Valuation, Profitability, Revisions, and Momentum.

PLAB Stock is a top Quant semiconductor (SA Premium)

PLAB is up 71% in the past year. Despite trading near a 52-week high, has maintained an ‘A’ Valuation Factor Grade highlighted by a forward P/E GAAP 50% below the sector median, and forward EV/EBIT and EV/EBITDA are more than a 68% difference.

8. Dropbox, Inc. (DBX)

-

Market Capitalization: $11.33B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 38 out of 552

-

Quant Industry Ranking (as of 2/9/24): 11 out of 191

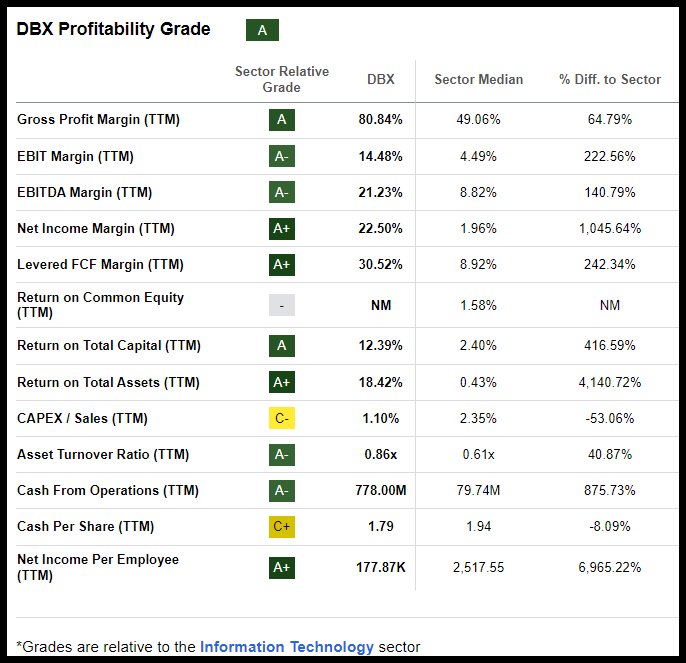

Dropbox is a collaboration platform that allows users to “drop” files in a shared location to help create, share, manage, and track content for improved productivity. Up more than 40% in the last 12 months, Dropbox is an application software company with back-to-back earnings.

In September, the SA Quant Team selected Dropbox as one of its Top 10 AI Stocks to Kick Off Q4. Since the publication date, Dropbox has soared nearly 20%, continues to expand margins, and possesses over $778M in cash from operations.

DBX Stock Profitability Grades (SA Premium)

Dropbox announced Q4 earnings on February 15th. Following its third-quarter 2023 EPS of $0.56, beating by $0.07, and revenue of +$633M, beating by $4.74M Y/Y, Dropbox teamed up with Nvidia to capitalize on the AI trend. Nvidia’s founder and CEO Jensen Huang said, “Together, NVIDIA and Dropbox will pave the way for millions of Dropbox customers to accelerate their work with customized generative AI applications.” Although DBX’s overall Valuation Grade is a ‘D,’ the stock offers discounted underlying valuation metrics, including a forward P/E Non-GAAP ratio of 16.63x versus the sector median of 25.44x and a forward PEG ratio that’s a 44% difference to the sector.

9. UiPath Inc. (PATH)

-

Market Capitalization: $13.79B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 8 out of 550

-

Quant Industry Ranking (as of 2/9/24): 2 out of 46

UiPath Inc. offers a range of robotic process automation (RPA) solutions, primarily in the United States, Romania, and Japan. PATH is #2 on the list of top quant-rated Systems Software stocks, and its most recent platform release delivered new AI capabilities designed to help customers accelerate productivity and spark innovation.

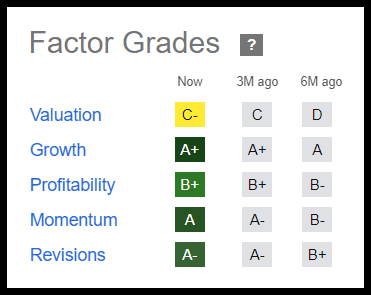

PATH Stock Factor Grades

PATH Stock Factor Grades (SA Premium)

UiPath CEO Rob Enslin said the company would continue investing in AI to further extend UiPath’s market leadership. PATH revenue grew at a CAGR of 35% since Q122 and possesses strong Factor Grades, including A’s in Growth, Momentum, and EPS Revisions, a B+ in Profitability, and C- Valuation.

PATH Stock Revenue Estimates

PATH Stock Revenue Estimates (SA Premium)

PATH has beaten EPS targets for 11 consecutive quarters and is expected to grow revenue by almost 22% to $1.29B, according to consensus estimates from 20 Wall Street analysts, and EPS by 238% in FY2024. Moreover, PATH has received 19 earnings up revisions in the past 90 days and no down revisions.

10. Qorvo, Inc. (QRVO)

-

Market Capitalization: $10.87B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/9/24): 37 out of 552

-

Quant Industry Ranking (as of 2/9/24): 2 out of 65

Last but not least, Qorvo, Inc., whose focus is on semiconductors and the development and commercialization of technologies is used in mass-market smartphones and many everyday devices. In Q2, more than 75% of Qorvo’s $1.1 billion in sales was derived from its Advanced Cellular Group (ACG) the remainder was split between High-Performance Analog (HPA) and Connectivity and Sensors Group (CSG). Nearly 50% of QRVO’s sales are generated from its business with Apple and Samsung.

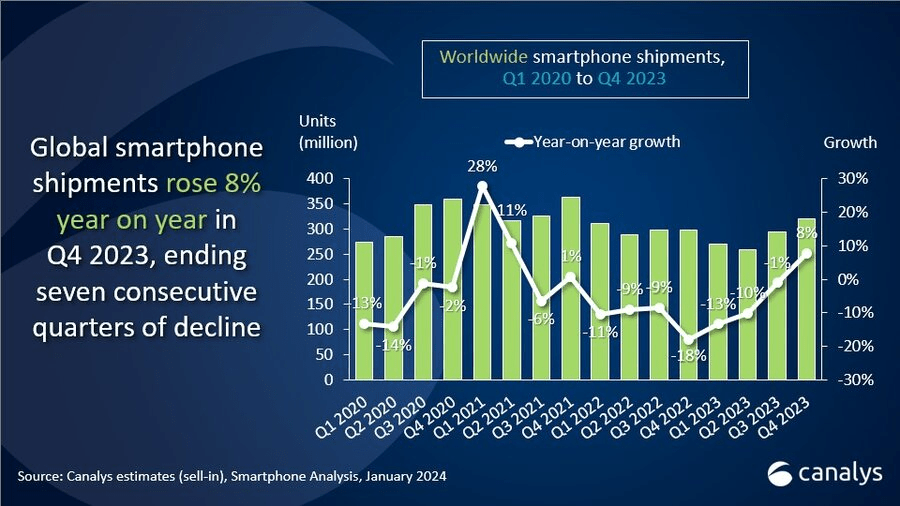

2024 Global Smartphone Analysis (Global Smartphone Analysis (Canalys))

QRVO has consecutively beaten earnings. Q3 EPS of $2.10 beat by $0.44, and revenue of $1.07B beat by a whopping 44.48% Y/Y. Non-GAAP gross margin was 43.8%, exceeding its guidance midpoint, and the company is benefiting from worldwide smartphone and content gains provided by its largest customers.

“On our last earnings call, we highlighted our content gains in the flagship tier. In addition to the ultra-wideband, Qorvo content this year includes the low band, mid-high-band, ultra-high band, secondary transmit and receive, tuning, and WiFi. We are ramping up now and building upon our momentum with a broad set of design wins in this customer’s high-volume mass-market portfolio,” said Qorvo President and CEO Robert Bruggeworth.

According to the Canalys research firm, worldwide smartphone shipment increased in Q423 to end seven consecutive quarters of declines. Capitalizing on this trend, QRVO is focused on growth and has experienced increasing margins. QRVO’s Growth Grade has been positively driven by long-term EPS (FWD) of 24%, which is about 80% above the sector median. In addition to Wall Street analysts revising estimates up, QRVO also possesses a C+ Valuation Grade. Although the valuation grade appears average, QRVO scores an ‘A’ in a key indicator that weighs value in the context of long-term growth projects. Qorvo’s forward PEG ratio of 0.77x versus the sector’s 2.04x is more than a 62% difference, and the company’s price target was increased by Barclays investment firm, which cited the firm as part of the “second wave” of AI.

Conclusion

Major indexes are being led by Top Technology stocks, with the tech sector (XLK) up nearly 50% over the last year. Artificial Intelligence is a trend that is prompting companies to evolve while capturing market share. The SA Quant Team’s top 10 tech stocks possess robust fundamentals that have delivered strong earnings results despite macro and geopolitical challenges. Most of these stocks have solid valuations, excellent growth, and profitability, with Wall Street analysts revising earnings up.

With Seeking Alpha Premium, you can find many stocks with ‘strong buy’ ratings. Consider using Stock Screens to filter through stocks that meet your preferences. Alternatively, Alpha Picks might be ideal if you’re interested in two monthly stock picks of the top ‘strong buy’ quant stocks. Seeking Alpha’s quant ratings and investment research tools help to ensure you are furnished with the best resources to make informed investment decisions while taking the emotion out of investing. Happy Investing!

Source link