Technology M&A | Bain & Company

This article is part of Bain’s 2024 M&A Report.

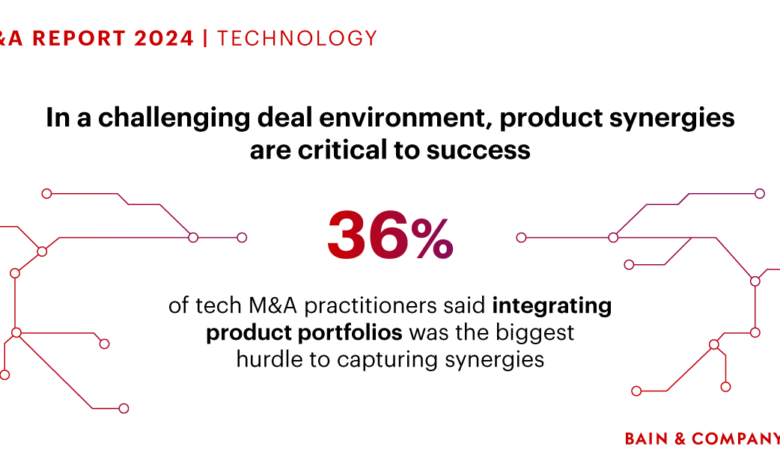

Many technology acquisitions begin with high aspirations for the breakthrough new capabilities and growth that can be achieved by combining the target’s technology with the acquirer’s portfolio, but these product synergies are rarely realized. Companies may dutifully write product synergies into deal papers, but they typically cannot provide the capital or thorough planning needed to make them happen.

In the past, companies were able to make successful acquisitions based on basic business growth and cost synergies alone. But in today’s market, that luxury no longer exists. Times are tough for acquirers. Higher interest rates make transactions more expensive. Macroeconomic uncertainty persists. In addition, regulatory scrutiny has extended the timeline for completion and even threatens the possibility of the transaction being completed.

But in this environment, M&A is more important than ever to technology companies’ strategies, according to our recent M&A Practitioner Survey. Technological innovation is still advancing rapidly, and artificial intelligence (AI) will reach an inflection point in 2023. As data becomes the new business currency, companies are at increased risk of expanding and reinventing their services. Despite AI-dominated headlines, cybersecurity, the metaverse, the intelligent edge, and other disruptive trends are also creating a need for companies to innovate or risk being left behind. For many in the industry, the time has come to reset and reinvent through M&A.

But now is not the best time for tech traders. Overall, sales volume fell by 26% and value by 59% in the first 10 months of 2023. This is more than nearly every other major industry. But despite the macroeconomic challenges, deals are still being struck, with more than 4,100 deals completed in the first nine months of this year. Thirty-one of these deals were worth more than $1 billion, but the majority were smaller deals aimed at expanding into new market segments or accessing new capabilities.

Opportunities may still lie ahead for companies that act with speed and boldness. Indeed, there are signs that lackluster trading activity may improve. In 2023, valuations have fallen approximately 45% from their post-pandemic record highs, with a median enterprise value-to-EBITDA multiple of 13x (see Figure 1). The gap between the valuations sellers need and the valuations buyers are willing to pay may be closing. In our survey of technology industry practitioners, 42% see narrowing the valuation gap as key to unlocking deal flow, and approximately 40% expect the gap to narrow next year.

Despite falling technology valuations, practitioners believe there is still a gap between buyer and seller expectations.Solving this issue is critical to enabling deal flow in 2024

Source link