iShares Expansion Tech Software Sector ETF (IGV): A great set of overvalued tech stocks

Dakuku

Can major software stocks survive the tech apocalypse of 2024? That’s the question I asked myself when reviewing the iShares Expanded Technology Software Sector ETF (Bat: IGV), this is one ETF that is currently on my slimmed-down watchlist of 100 ETFs. Most of my work is focused. In recently cutting my watchlist in half, one of the key factors in deciding what to keep and what to remove was how “concentrated” the sector, especially industry-covered stock ETFs are. was. In other words, fewer stocks will move the bus. As with stocks, investors seeking opinions on ETFs will likely prefer that analysts focus the most attention on their “best ideas.” This is similar to how his ETF in the software industry puts many eggs in a few baskets, rather than equally weighting hundreds of stocks.

IGV is Please hold off on your evaluation here. However, it is based on the evaluation of the field, not the quality of business in that field. This is part of my watchlist, so I’ll definitely keep tracking it. But I don’t own it, and the hold rating simply tells me that if I owned it, I would look for further evidence before selling. If that evidence develops, it will come in the form of an acceleration of price declines, likely starting in the tech industry in early 2024.

IGV: Main features

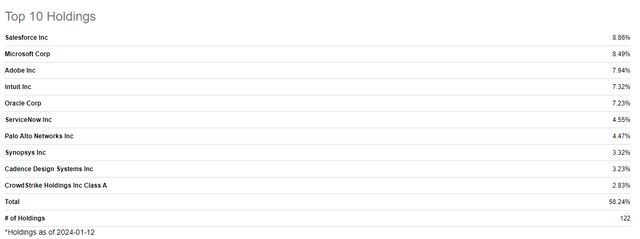

This ETF tracks the Software Index, which is an index of companies that represent subsectors (aka industries) within the broader technology sector, and is heavily concentrated in its five largest holdings. The top 5 stocks account for 40% of his ETF and the top 10 stocks account for his 58% of his current IGV portfolio.

In search of alpha

IGV’s focus is clearly on the software industry, as its name suggests. The portfolio is invested in the technology sector (96%), of which 3% is invested in the telecommunications sector, with a small allocation also in the financial and industrial sector. Opened in 2001, it effectively manages approximately $7.6 billion in assets and trades approximately $300 million per day. It’s very large and has a lot of liquid.

IGV currently holds 122 stocks, but that doesn’t tell the whole story considering the facts cited earlier about how concentrated this ETF is. IGV, like other focused ETFs, allows you to better understand what it is and what is likely to drive its future performance.

Possibilities of IGV: Focus!

As I’ve written many times here, I’m not your typical ETF analyst or strategist. I support a lot of research that shows that when you add one stock to another and then another, the diversification quickly turns from adding value. However, beyond 20 to 30 stocks, the benefits of diversification diminish rapidly.

Here we’re talking about IGVs, which are likely to be a modest part of your portfolio. When I invest in industry ETFs like this, it’s usually 5% to 15% of the total portfolio. Therefore, I prefer not to spread hundreds of stocks into a small portion of an overall “basket” of stocks.

So I don’t see IGV as 122 stocks, but as these five tech/software giants (which make up about 40% of the ETF), plus a bunch of “bros” that go along with them.

Business performance has been good, but what will happen in the future?

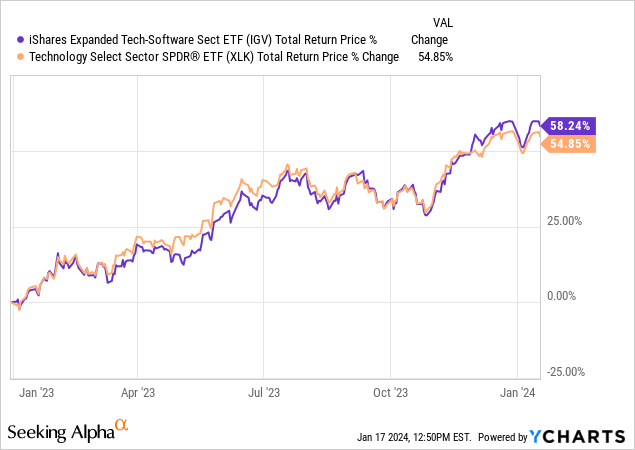

Performance in 2023 was strong. Very strong recent performance has boosted the valuation. However, the software market still has growth potential. And while this is a group with a high concentration of very powerful and profitable businesses, the biggest risk is not the fate of those businesses. Rather, it is the short-to-medium term fate of the stock. Its focus on larger, more stable software companies should allow it to weather the volatility of the tech market better.

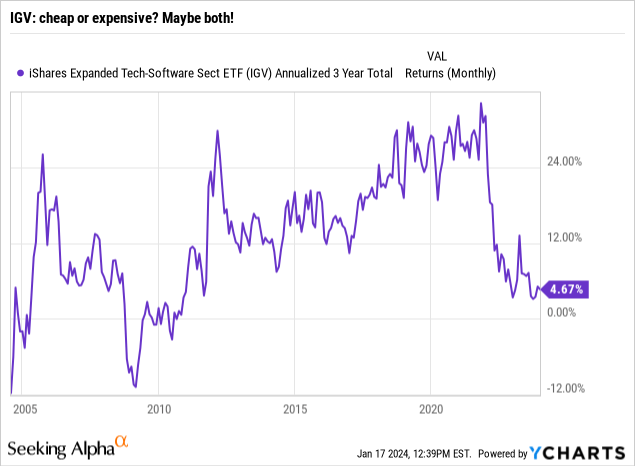

Take a look at the graph above. The most bullish thing I can say about IGV is that his three-year annualized return hasn’t been this low since his 2012. Indeed, we may be becoming the proverbial “falling knife.” But this does at least draw my attention to it as a potential tech sector leader, especially if there is a large drawdown this year.

IGV soared along with the tech industry in 2023, but what’s next? Take a look at Seeking Alpha’s excellent Factor Grade system to see the top 5 stocks.

Factor grade highlights

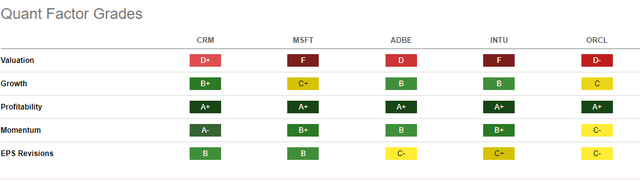

An analysis of the five major holdings that account for 40% of IGV reveals the following. Look at this revenue line. Overall A+. So step one of my process is encouraging. These are great businesses. They are great stocks too. But are those prices right?

In search of alpha

The momentum is strong, but it’s in the past tense. I’m not a huge fan of focusing on momentum as an investment factor when new capital is involved. These columns of valuations for the top five stocks are based on report cards that when I was growing up (1970s and 1980s), when paper report cards still existed, people would have thrown them away without showing them to their parents. similar. Luckily, I didn’t have to face that decision (solid B+ student).

IGV’s P/E ratio reaches 47x through early 2024. If these companies continue to grow like crazy, that’s okay. However, that may be nearly impossible. So, I have reservations.

IGVs, along with the broader technology sector, could become victims of their own success

IGV is a must on my 100 ETF watchlist. I like its focus, its collection of high-quality businesses, and its potential use as a way to target a narrower slice of the broader tech sector in this post-pandemic era. But valuation doesn’t get us there, and while the overall technical picture is better than technology as a whole, it still doesn’t scream buy. I’m not calling for a long-term sell either. So my hold rating is:

Source link