Integrating traditional finance and blockchain: The role of real-world assets in cryptocurrencies

Integration of real world assets (RWA) into cryptocurrencies. It is an important development in finance that bridges traditional assets and blockchain technology. Find out how RWA provides a practical connection between the physical and digital worlds, enhancing the functionality, comprehensiveness, and connectivity of the financial system.

The combination of real world assets (RWA) and the cryptocurrency ecosystem Big change in the financial climate. Starting in the early 2010s with fiat-backed stablecoins such as Tether (USDT), the RWA space has expanded, especially with the rise of DeFi in 2020 and subsequent market changes. Currently, RWA covers a wide range of tangible assets such as debt, credit, real estate, art, and collectibles, creating a tangible link between traditional financial assets and blockchain technology.

Understand RWA

RWA acts as a link between the physical and digital worlds, acting as an intermediary that brings real-world value to the decentralized space of cryptocurrencies. This integration is facilitated by strategic use of third-party services such as timely data oracles, asset protection custodians, and valuation experts to ensure RWA reliability and trustworthiness.

The significant growth of the RWA sector is evidenced by the following findings: CoinGecko’s RWA Report 2024:

- Leading USD-based stablecoins: This accounts for 99% of the stablecoin market capitalization, highlighting the important role that fiat-backed tokens play in the stability of the cryptocurrency market.

- Growth of commodity-backed tokens: With a market capitalization of $1.1 billion, gold-backed tokens like Tether Gold (XAUT) and Pax Gold (PAXG) are at the forefront.

- The rise of tokenized financial products: It represents a 641% increase in 2023, demonstrating the growing interest in secure and income-generating digital assets.

- Focus on private credit in the automotive sector: Accounting for 42% of all loans, it shows a notable trend towards sector-specific lending in DeFi.

ONDO: Prominent figures in the RWA world

In a dynamic RWA environment, Ondo It stands out for its significant achievements. ONDO’s performance, which reached a new high of $0.9744, reflects the growing interest in RWA among investors due to the following factors:

- Launch of BlackRock’s BUIDL Fund: It demonstrates the remarkable integration of traditional finance and blockchain, making RWA more attractive and reliable.

- Strengthening through ecosystem partnerships: ONDO has solidified its position in the DeFi sector through its efforts in tokenized financial products and partnerships with blockchain platforms.

- Introducing Ondo Global Markets: Enabling the tokenization of traditional securities enhances ONDO’s capabilities and expands its use and appeal.

ONDO demonstrates the potential of decentralized governance in shaping the future of finance. As RWA continues to gain traction, collaboration between digital tokens and real-world assets is expected to become a fundamental element of the new financial era, and ONDO is committed to creating a more functional, secure and interconnected financial environment. shows the transformative potential of RWA in promoting .

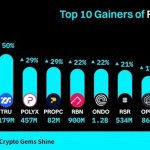

Take a look at trending RWA tokens

The RWA token ecosystem is diverse and reflects the wide range of real-world assets that are integrated into blockchains. His review of notable RWA tokens, including ONDO, shows the development and attractiveness of this sector.

- Various growth and market capitalizations: Tokens like PROPS, TRU, POLYX, PROPC, RBN, RSR, OPUL, SNX, and MKR are poised for growth in areas ranging from digital content rewards to decentralized credit, lending, real estate tokenization, music rights, and synthetic assets. and innovation, demonstrating the sector’s potential.

Impact of RWA in Cryptocurrency

The achievements and diversity of RWA tokens mark a significant transition in the crypto domain. By linking tangible, real-world assets to the blockchain, these tokens not only provide an investment vehicle, but also enhance the liquidity, accessibility, and democratization of assets. From the tokenization of products and securities to innovative financial tools in lending and yield generation, RWA is expanding the scope of decentralized finance possibilities.

As the sector matures, RWA could help bridge the gap between traditional finance and DeFi, leading to a more resilient, stable, and diverse ecosystem. The progress of ONDO and similar tokens demonstrates the cryptocurrency community’s ability to innovate and redefine and improve the financial landscape. For those in the cryptocurrency industry, the emerging RWA sector presents new opportunities that combine the reliability of traditional assets with the innovation and flexibility of blockchain technology.

biget We invite enthusiasts to take a deep dive into the evolving world of RWA tokens. provide a gateway Toward the wide range of possibilities of decentralized finance.