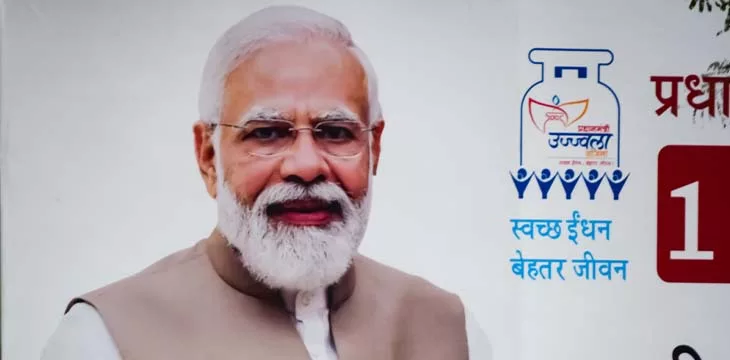

Indian Prime Minister says AI, blockchain will change the way banking is done

Indian Prime Minister Narendra Modi said new technologies such as artificial intelligence (AI) and blockchain have completely changed the way banking is done. Said.

As a result, the role of cybersecurity has become critical in the growing digital banking era. Fintech innovations will create new ways of banking, he said.

“In this situation, we need to think about what changes will be required in the country’s banking sector and its structure. We may need new financing, new operations and new business models. No,” PM Modi said while speaking at the 90th anniversary celebrations of the Reserve Bank of India (RBI).

Prime Minister Modi also emphasized the need for the RBI to plan and chart the future trajectory of the Indian banking system to support India’s growth ambitions over the next decade.

India is scheduled to hold general elections later this month, and Mr. Modi expects his party and its allies to win more than 400 seats over the next five years and a majority in the 543-member lower house. The world’s largest democracy, with a population of 1.4 billion, will vote from April 19 to June 1, with around 970 million Indians, more than 10% of the world’s population, eligible to vote. .

with prime minister modi Vikshit Bharat (Developed India) goal will leverage AI and blockchain technology as key catalysts to achieve the $5 trillion economic goal by 2027-2028. The world’s most populous country recently approved more than 10.3 billion rupees ($1.24 billion) for IndiaAI missions planned over the next five years. This capital infusion aims to boost the country’s AI ecosystem, innovation and entrepreneurship.

India also plans to release a draft regulatory framework for AI by July to harness the technology for economic growth while putting in place guardrails to prevent misuse. The South Asian country is expected to become a major global player in emerging technologies and the third largest economy after the United States and China.

“As consumer preferences change, the banking and financial services industry will need to reorient its business models, processes and products. To address this change, the RBI will We have started the groundwork to enhance the use of technology in banking, including cases,” RBI Deputy Governor M. Rajeshwar Rao said in March.

“Let me also add here that technology brings its own set of challenges in the form of data protection, cybersecurity and technology-induced fraud. This is an area that is receiving a lot of attention,” Rao added.

The RBI, which is using blockchain technology for its Central Bank Digital Currency (CBDC) or e-rupee, said it is considering enabling additional programmability and offline functionality in retail payments in the CBDC. The CBDC retail pilot currently allows person-to-person and person-to-seller transactions.

Although the RBI has not set a concrete timeline for the “full-scale” launch of the CBDC, significant progress has been made in the scale of the pilot project. India has around 4.3 million CBDC retail users, with an additional 400,000 merchants using e-Rs.

For artificial intelligence (AI) to function properly within the law and succeed in the face of growing challenges, it must integrate enterprise blockchain systems that ensure the quality and ownership of data input. This makes it possible to ensure data security while also guaranteeing immutability. of data. Check out CoinGeek’s coverage Learn more about this new technology Why enterprise blockchain is the backbone of AI.

Watch: Highlights of the Enterprise Utility Blockchain Summit — India is making massive expansions for a better internet

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section. This is the ultimate resource guide to learn more about blockchain technology.