Buy these 3 tech stocks for upside potential this week

Rapid digital transformation, technological advancements, and cutting-edge technology have enabled the high-tech hardware industry to thrive, and its growth is expected to continue steadily. This industry offers many opportunities for hardware companies to take advantage of the growing demand for computing devices and specialized hardware components.

Given the positive outlook for the industry, fundamentally sound tech stocks NetApp Inc. (NTAP), Ricoh Inc. (RICOY), and Iteris Inc. (ITI) are poised for potential gains this week. It may be wise to invest in

Technology hardware is a fast-moving, constantly evolving market. This includes computer hardware and technology, storage devices, networking equipment, peripherals, infrastructure, and semiconductors. Demand for high-tech hardware is driven by capital investment by businesses, as well as consumer and government spending.

According to a report by Business Research Company, the global computer hardware market is expected to reach $909.8 billion by 2027, growing at a CAGR of 6.6% during the forecast period. The market is currently experiencing significant growth due to rapid advancements in technology and increasing demand for computing devices in various end-use industries.

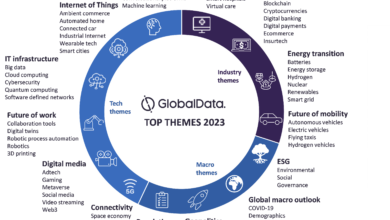

Additionally, the computer hardware market is driven by the proliferation of cloud computing, the rise of the Internet of Things (IoT), and the increasing need for high-performance computing and data processing. Additionally, advances in artificial intelligence (AI) and machine learning (ML) are increasing the demand for specialized hardware components.

Common AI hardware components include central processing units (CPUs), graphics processing units (GPUs), tensor processing units (TPUs), field programmable gate arrays (FPGAs), application-specific integrated circuits (ASICs), and edge compute units. It consists of a processing chip and a memory system. , storage solutions, and other related devices.

According to a report by Precedence Research, the global AI hardware market is expected to exceed approximately $248.09 billion by 2030, expanding at a CAGR of 24.5% from 2023 to 2030.

Investor interest in high-tech hardware stocks is evidenced by the S&P Technology Hardware Select Industry Index’s return of 16.2% over the past year.

Given these encouraging trends, let’s analyze the fundamental aspects of the three best stock picks in Technology – Hardware, starting with our third pick.

Stock #3: NetApp, Inc. (NTAP)

NTAP provides cloud-driven, data-centric services for managing and sharing data internationally, on-premises and in private and public clouds. The company operates in two segments: hybrid cloud and public cloud. It serves the energy, financial services, technology, government, life sciences, media, healthcare services, entertainment and animation markets.

On November 7, NTAP announced a new bundled virtualization solution sold and marketed by Fujitsu, a VMware and NetApp reseller. This integrated, affordable virtualization infrastructure solution helps small and medium-sized businesses simplify and accelerate the management of traditional and modern applications. This new launch is likely to boost the company’s growth.

On the same day, NTAP announced NetApp StorageGRID for VMware Sovereign Cloud. His NetApp Plug-in for VMware Cloud Director Object Storage Extension allows Sovereign Cloud customers to more cost-effectively store, secure, and protect unstructured data while meeting global data privacy and residency regulations. , you will be able to save it.

NetApp also introduced NetApp ONTAP Tools for VMware vSphere (OTV 10.0), designed to simplify and centralize enterprise data management across multi-tenant vSphere environments.

Also on August 24, NTAP expanded its partnership with Google Cloud to deliver a new level of storage performance combined with the simplicity and flexibility of the cloud.

With the introduction of Google Cloud NetApp Volumes, now available as a fully managed first-party service on Google Cloud, customers can deploy business-critical applications in both Windows and Linux environments, even for the most demanding use cases. Now you can seamlessly deploy your workloads to Google Cloud. Similar to VMware or SAP migrations, there is no need to refactor code or redesign processes at all.

NTAP’s gross profit margin and net profit margin for the trailing twelve months were 67.06% and 19.49%, which were 35.7% and 789.6% higher than the industry averages of 49.41% and 2.19%, respectively. Additionally, the stock’s trailing 12-month leveraged FCF margin of 20.60% is 179.1% higher than the industry average of 7.38%.

NTAP pays an annual dividend of $2 per share, which translates to a current stock price yield of 2.65%. The average dividend yield over four years is 3.04%. The company’s dividends have increased at a CAGR of 10.8% over the past five years.

NTAP reported net revenues of $1.43 billion for the first quarter of fiscal 2024, ended July 28, 2023. Public cloud segment revenue increased 16.7% year over year to $154 million. Non-GAAP net income was $249 million, or $1.15 per share. The company’s net cash provided by operating activities increased 61.2% year over year to $453 million.

Street expects NTAP’s fiscal year ending April 2024 to report EPS of $5.73, up 2.5% year-over-year. The company’s EPS and revenue are expected to increase 7.4% and 4.4% year over year to $616 million and $6.41 billion in fiscal 2025, respectively. Additionally, it beat consensus EPS estimates in each of the trailing four quarters.

NTAP stock has increased 18.1% over the past six months and 24.4% since the beginning of the year, closing at $75.60. It has risen 9% over the past year.

NTAP’s POWR rating reflects its solid outlook. The stock has an overall rating of “B”, which equates to a “buy” according to our proprietary rating system. POWR ratings are calculated by considering 118 different factors, with each factor weighted to the best degree.

NTAP quality is A grade. B-rated Technology – Ranked #15 out of 38 stocks in the Hardware industry.

In addition to the POWR Rating highlighted here, you can find NTAP’s ratings for Growth, Value, Momentum, Stability and Sentiment here.

Stock #2: Ricoh Company, Ltd (Lykoi)

RICOY is based in Tokyo and provides office and commercial printing and related solutions. Operated through digital services. digital products. graphic communication. and Industrial Solutions Division. The company sells multifunction printers (MDPs), laser printers, scanners, personal computers, networking equipment, and related parts and supplies.

Ricoi and Toshiba Tec announced on August 24 that they will integrate their multifunction printer development and manufacturing businesses and proceed with the necessary procedures, including a simple absorption-type company split that will establish a joint venture company with Ricoh as a shareholder. Develops multifunctional printers with Toshiba Tec.

On June 19, RICOH released the RICOH SC-20, a work inspection camera that uses image recognition technology to check the appropriateness of manual work processes in real time.

The RICOH SC-20, the successor to the RICOH SC-10A, is a smart camera that uses image recognition technology to automatically check the status of parts assembly work and prevent work errors. The new product offering should bring significant benefits to the company.

RICOY’s trailing twelve month net profit margin of 2.55% was 16.3% higher than the industry average of 2.19%. Similarly, the company’s trailing 12-month ROCE and ROTA of 5.93% and 2.51% are significantly higher than the industry average of 0.62% and 0.31%, respectively.

For the six months ended September 30, 2023, RICOY’s sales increased 14.3% year-on-year to 1.11 trillion yen ($7.38 billion). Gross trading profit increased 11.5% year on year to 386.2 billion yen ($2.57 billion). The company’s profit attributable to owners of the parent company increased 4.7% year-on-year to 15.6 billion yen ($103.74 million).

Additionally, net income per share attributable to owners of the parent company was 25.62 yen, an increase of 7.3% compared to the same period last year. Cash inflow from operating activities was 31.4 billion yen ($208.81 million), and cash outflow from operating activities for the same period in 2022 was 3.7 billion yen ($24.6 million).

Analysts expect RICOY’s revenue to increase 4.3% year-over-year to $3.66 billion in the second quarter of fiscal 2024 (ending September 2023). The company’s revenue is expected to increase 302.5% year over year to $15.03 billion in the fiscal year ending March 2024. Additionally, RICOY beat consensus revenue estimates in each of his four subsequent quarters.

RICOY stock has increased 4.4% over the past six months and 16.3% over the past year, closing at $8.30.

RICOY’s POWR rating reflects its solid outlook. The stock has an overall rating of “B”, which equates to a “buy” according to our proprietary rating system.

RICOY’s value and stability are B grade. B-rated Technology – Ranked #6 out of 38 stocks in the Hardware industry.

Click here to see additional ratings for RICOY on Growth, Momentum, Sentiment, and Quality.

Stock 1: Iteris Co., Ltd. (ITI)

ITI provides intelligent transportation system technology solutions around the world. The company’s smart mobility infrastructure solutions include traveler information systems, transportation performance measurement software, traffic analysis software, and advanced sensing devices. Our products include ClearGuide, ClearRoute, BlueArgus, TrafficCarma, Vantage Apex, and Vantage Fusion.

On October 31, ITI signed a contract with the Federal Highway Administration for up to $9.5 million to provide continued development, evolution, and deployment support for the nation’s Intelligent Transportation System (ITS) Reference Architecture Program .

Under the three-year agreement, ITI will develop the Architecture Reference for Cooperative Intelligent Transportation (ARC- IT) supports the evolution of content. This deal should bode well for the company.

In September, ITI launched Vantage Next Max™. This is a new central control unit (CCU) that doubles the number of sensors supported on the Vantage Next® platform from four to eight per in-cabinet processor. This enhancement is designed to enhance traffic detection at large or uniquely configured intersections, saving time and effort for traffic engineers and system integrators.

ITI’s revenue for the first quarter ended June 30, 2023 was $43.55 million, an increase of 29.3% from the same period last year. Gross profit increased 65.4% year-on-year to $16.8 million. Adjusted EBITDA was $3.68 million, compared to adjusted EBITDA of -$2.45 million in the prior year period.

Additionally, the company’s net income was $2.13 million, or $0.05 per share, compared to a net loss of $4.87 million, or $0.11 per share, in the year-ago period. Cash and cash equivalents as of June 30, 2023 were $19.99 million, compared to $16.59 million as of March 31, 2023.

Analysts expect ITI’s sales for the fiscal year ending March 2024 to be $173.02 million, an increase of 10.9% year-over-year. Fiscal 2025 sales and EPS are expected to increase 10.7% and 34.2% year over year to $191.52 million. $0.37 each. The company also beat consensus revenue estimates in each of his four subsequent quarters.

ITI stock has increased 46.4% since the beginning of the year and 60% over the past year, closing at $4.48.

ITI’s sound fundamentals are reflected in its POWR ratings. The stock has an overall rating of A, which equates to a “Strong Buy” according to our proprietary rating system.

The stock has a B grade for growth potential and sentiment. ITI ranks third in its industry.

In addition to the above, we also evaluated value, quality, stability, and momentum. Get all ITI ratings here.

What’s next?

Discover 10 widely held stocks that our proprietary model shows has big downside potential. Make sure it’s not one of these. ”death trapThe following stocks are lurking in your portfolio:

10 stocks to sell right now! >

NTAP stock was unchanged in premarket trading Wednesday. Year-to-date, NTAP has increased his 29.61%. In comparison, the benchmark S&P 500 index rose 15.52% in the same period.

About the author: Mangeet Kaur Bounce

Mangeet’s keen interest in the stock market led him to become an investment researcher and financial journalist. Using a fundamental approach to analyzing stocks, Mr. Mangeet seeks to help retail investors understand the underlying factors before making investment decisions. more…

Additional resources for stocks in this article

Source link